For aspiring TC startups in Texas, building a legally secure foundation is critical for mitigating legal risks, protecting personal assets, and establishing credibility.

However, since real estate is a place-sensitive industry, the legal requirements and best practices for starting a transaction coordination (TC) business vary widely across states.

Different states may have unique rules governing business entities, insurance obligations, and the contracts required to operate effectively.

In this article, we’ll provide a detailed, actionable guide tailored to Texas-based TC startups.

Legal Compliance: The First Step Toward Success

Real estate transaction coordinators in Texas must be vigilant about regulations specific to the state:

- Real Estate Requirements: TCs generally don’t need to be licensed real estate agents, but certain tasks may require a license under Texas Real Estate Commission (TREC) guidelines. Review your business activities to ensure compliance.

- Tax Obligations: Texas imposes a state sales tax on some services, depending on your business structure. Ensure you’re aware of these obligations to avoid penalties.

Checklist to Start

- Research state laws and local ordinances relevant to your business operations.

- Bookmark resources like the Texas Secretary of State and Texas Comptroller for ongoing compliance.

- Engage legal professionals to advise on corporate formalities and legal risks.

Step 1: Choosing the Right Business Entity

The business entity type you choose greatly influences your legal protection, tax considerations, and control of the TC business. It will also affect daily business operations, personal liability, and, where applicable, your ability to pursue potential investors or business partners.

Entity Options for TCs in Texas

Sole Proprietorship

This is the simplest and least costly form of ownership for new entrepreneurs. It requires the least paperwork and no official registration other than obtaining local business licenses.

Personal assets are directly vulnerable to a business’s legal liabilities or debts; thus, sole proprietorships are too risky for TCs involved in sensitive real estate transactions.

Limited Liability Company (LLC)

A combination of the simplicity of a sole proprietorship with strong liability protection.

Single-member LLCs are particularly attractive to tax professionals such as tax consultants because their finances are kept separate from personal entities. Yet, a simple taxation infrastructure is maintained.

It offers more flexibility in taxation since, for the most part, taxation can be done as either a sole proprietorship or partnership or as a corporation, usually an S-Corp or C-Corp.

S Corporation (S-Corp)

This is an advanced option for big-volume businesses with substantial revenue. It provides limited liability like an LLC but allows for more tax savings by bypassing certain self-employment taxes.

However, it has more rigid requirements regarding the number of shareholders, for instance, and to observe the more complex formalities of a corporation.

Why an LLC is Ideal for TCs

An LLC balances simplicity and liability protection, making it the most practical choice for Texas-based TCs. By forming an LLC:

- You shield personal assets from legal disputes or business debts.

- You gain credibility with potential investors and clients.

- You retain flexibility in tax planning, an essential consideration for a growing business venture.

Moreover, the LLC setup process in Texas is straightforward and relatively affordable compared to other states.

Step-by-Step: Forming an LLC in Texas

- Choose a Name:

- You can search the Texas Secretary of State’s database to ensure your name is unique and follows naming regulations.

- Include “LLC” or “Limited Liability Company” to comply with state laws.

- File a Certificate of Formation:

- Submit Form 205 online or by mail to officially register your LLC.

- Cost: Approximately $300 for the filing fee.

- Appoint a Registered Agent:

- Designate an individual or service to receive legal documents, such as lawsuits or official notices, on behalf of your LLC. This ensures compliance with Texas law.

- Obtain an EIN:

- You can apply for a free Employer Identification Number (EIN) through the IRS website. This number is essential for filing taxes, opening a business bank account, and hiring employees.

- Open a Separate Bank Account:

- Keeping personal and business finances separate reinforces liability protection and simplifies bookkeeping.

- Choose a reliable bank that specializes in small businesses and startups.

- File for Local Permits:

- Research city or county-specific business licenses or permits required for your TC operations.

- Many localities in Texas may require occupational permits, particularly for businesses engaging with real estate transactions.

Pro Tip:

While forming an LLC is relatively straightforward, consulting a CPA or legal professional ensures that your business structure aligns with your financial goals and legal obligations. This step is especially important if you anticipate scaling your operations or seeking assistance with financing through business loans or potential investors.

An LLC protects you from legal risks and positions your TC business as a professional and trustworthy entity in the competitive Texas real estate market.

Step 2: Securing Insurance

Insurance provides a safety net for unforeseen events, protecting your business venture from financial loss. Coverage is critical to minimizing legal risks, Whether professional liability insurance for errors or general liability insurance for accidents.

Insurance Policies Every Texas TC Needs

- General Liability Insurance: Covers claims of property damage or bodily injury related to your business operations. It costs $400–$600/year.

- Errors & Omissions (E&O) Insurance: This policy, often called professional liability insurance, protects against claims of negligence, mistakes, or oversights in your services. E&O insurance ranges between $700 and $1,200/year.

- Workers’ Compensation Insurance: If you hire employees, this coverage is mandatory under Texas employment laws. This will vary with your payroll.

- Business Owner’s Policy (BOP): It combines multiple coverages, such as property and liability insurance, for added convenience. The cost of BOP is around $50-$200/month.

Checklist for Getting Insured

- Research providers experienced with Texas small businesses or real estate services.

- Compare quotes to find the best fit for your business activities and budget.

- Start with E&O Insurance to protect your services and clients.

- Revisit your coverage annually, especially if expanding into coworking spaces or hiring key employees.

Step 3: Drafting Strong Client Contracts

Contracts set clear boundaries and expectations for all parties and protect everyone against misunderstandings, disputes, and legal actions.

Key Contract Elements for Texas TCs

- Scope of Work: Be explicit about included and excluded tasks.

- Payment Terms: Define pricing, billing schedules, and refund conditions.

- Termination Clauses: Outline how and under what conditions the agreement can end.

- Liability Limitations: Specify limits to your responsibility for errors.

Texas-Specific Tips

- Include TREC disclosures to align with real estate agent compliance standards.

- Use state-compliant Non-Disclosure Agreementss to protect client confidentiality.

Checklist for Contracts

- Begin with a customizable TC contract template.

- Tailor terms to reflect your legal obligations and business structure.

- Hire a business attorney to review your legal agreements for enforceability.

Step 4: Staying Compliant with Texas Regulations

Operating a compliant TC business involves complying with all Texas regulations. By observing these laws, you will avoid penalties, your business will remain reputable, and you will not face legal action.

Licensing Regulations

Some transaction coordination activities in Texas could bleed over into licensed real estate agent duties, such as providing counsel that may be considered real estate agency duties.

Reviewing the Texas Real Estate Commission’s rule to ensure that your activities do not require a real estate license is a good idea.

Suppose your activities constitute the license requirements of the TREC. In that case, you should engage the services of a licensed broker to ensure that you comply with the law.

Data Protection Laws

When you handle sensitive information about customer data, such as financial and personal data, you are legally obligated to prevent unauthorized access. Failure or non-compliance with data security laws can result in serious legal liabilities, penalties, and lawsuits for damages.

- Use software that provides for document sharing and storage while encryption is in place to prevent unauthorized access.

- Provide role-based access to protect sensitive information from unauthorized team members.

- Develop a policy to securely delete obsolete client records, minimizing risks related to data breaches.

Checklist for Staying Compliant

- Participate in Legal Workshops:

- Attend workshops and webinars on Texas real estate law to stay updated on legal formalities, including TREC guidelines and employment laws.

- Organizations like the Texas Association of Realtors offer valuable resources and training sessions.

- Use Encrypted Tools and Platforms:

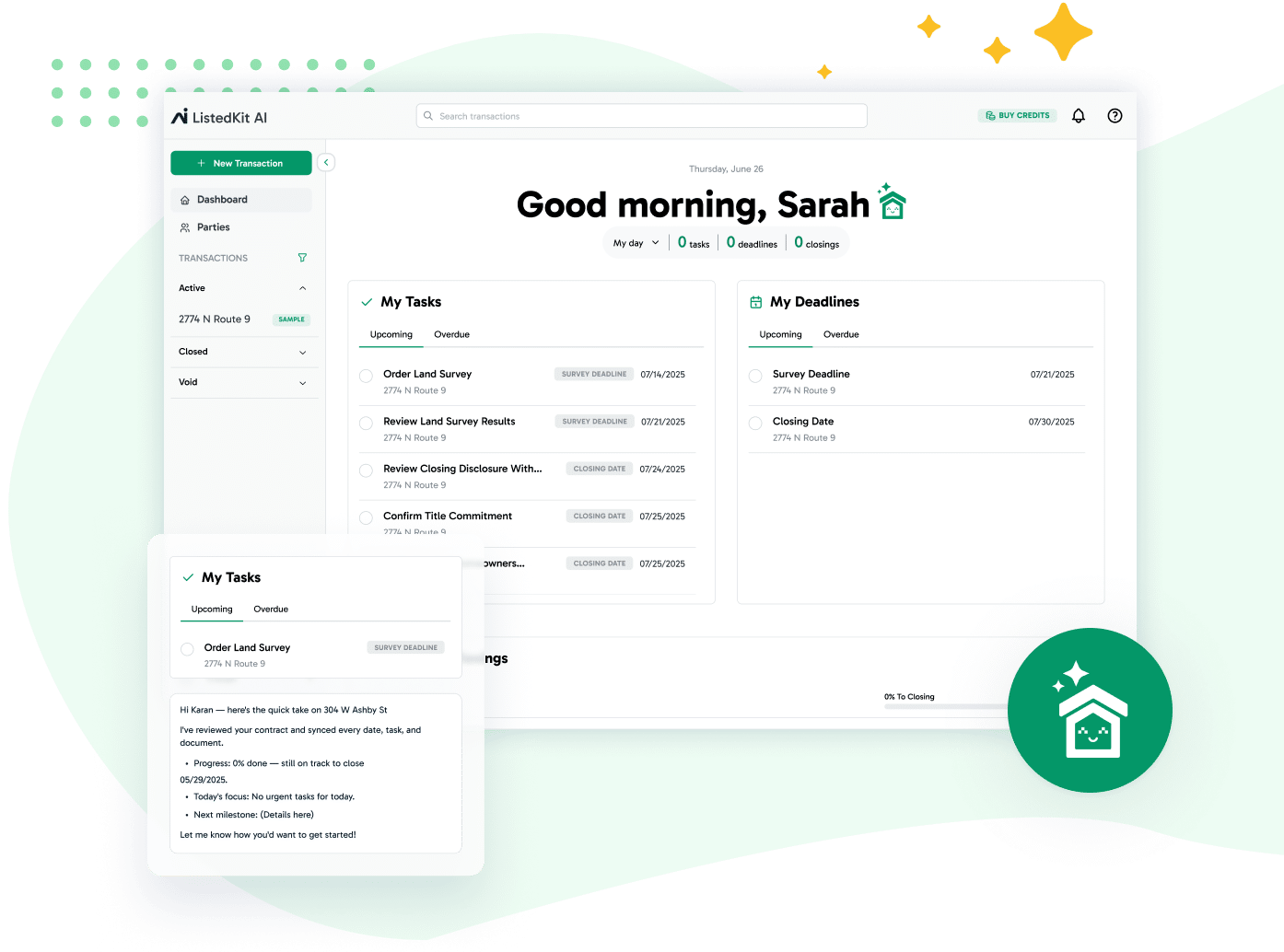

- Invest in real estate-specific software that meets data privacy standards. Platforms ListedKit and Dotloop are popular among TCs for secure document management.

- Ensure your contracts and client records are stored in compliance with Texas legal requirements.

- Conduct Regular Audits:

- Schedule periodic internal audits of your processes to identify compliance gaps and proactively address potential risks.

- Consider hiring legal professionals to review your operations externally, particularly as your business grows.

Step 5: Creating a Legally Sound Workflow

An organized workflow minimizes potential risks and ensures your business operations comply with legal formalities.

Example Workflow

- Client Onboarding: Start with a consultation and execute employment agreements or service contracts.

- Service Delivery: Perform tasks in alignment with the scope of work outlined in your contracts.

- Approval & Archival: Obtain client approval and securely archive documents for future reference.

Checklist for a Legally Sound Workflow

- Use legally compliant project management tools.

- Maintain detailed records, including corporate documents, liability protection policies, and client contracts.

- Ensure employee handbooks and agreements are updated to reflect changes in Texas employment laws.

Launching a Legally Sound TC Business in Texas

Starting a transaction coordination business in Texas requires careful legal considerations and a solid understanding of state-specific requirements.

Choosing the right business entity, securing essential insurance, drafting robust contracts, and staying compliant with Texas laws can solve potential issues and position your business for success.

If you need further assistance with financing or legal matters, consider consulting experienced legal professionals who can help you navigate the intricacies of Texas business law.

You can also sign up for our newsletter for more valuable content about running a TC business.