By Allyson Kurak, owner of Stitched Real Estate.

Starting a transaction coordinator business requires a strong foundation to minimize liability for you and your business. In this blog, Allyson delves into essential areas like navigating state and local regulations to ensure legal compliance within your market. Understanding your insurance needs is crucial, so we’ll also explore the importance of E&O insurance to protect your business from unexpected issues. Efficient record-keeping is vital, so we’ll touch on strategies for developing an organized system for storing and retrieving transaction documents. So, keep reading to discover Allyson’s strategies for building a thriving transaction coordinator business while minimizing liability.

Minimizing Liability for Your TC Business

The foundation of any successful business is built on a strong legal and operational framework. This is especially true for transaction coordinators (TCs), who navigate complex transactions involving sensitive information. Here are some key strategies to minimize liability for your TC business.

State, local, and brokerage guidelines

One of the first steps you should take in minimizing liability for your transaction coordinator business is researching your state and area requirements. Some states do have licensing requirements for transaction coordinators or at least, there may be tasks that a licensed vs unlicensed assistant can and cannot do. Before you start your business, determine your market area and then research if there are any requirements or limitations. If you are licensed, you may also want to confirm any requirements within your brokerage.

E&O Insurance

To protect your business, E&O insurance is also crucial. Your local insurance broker or business lawyer can be a great place to start with recommendations for E&O insurance providers. From there, the insurance broker or provider can go through the best options for you and your business.

Transaction Records

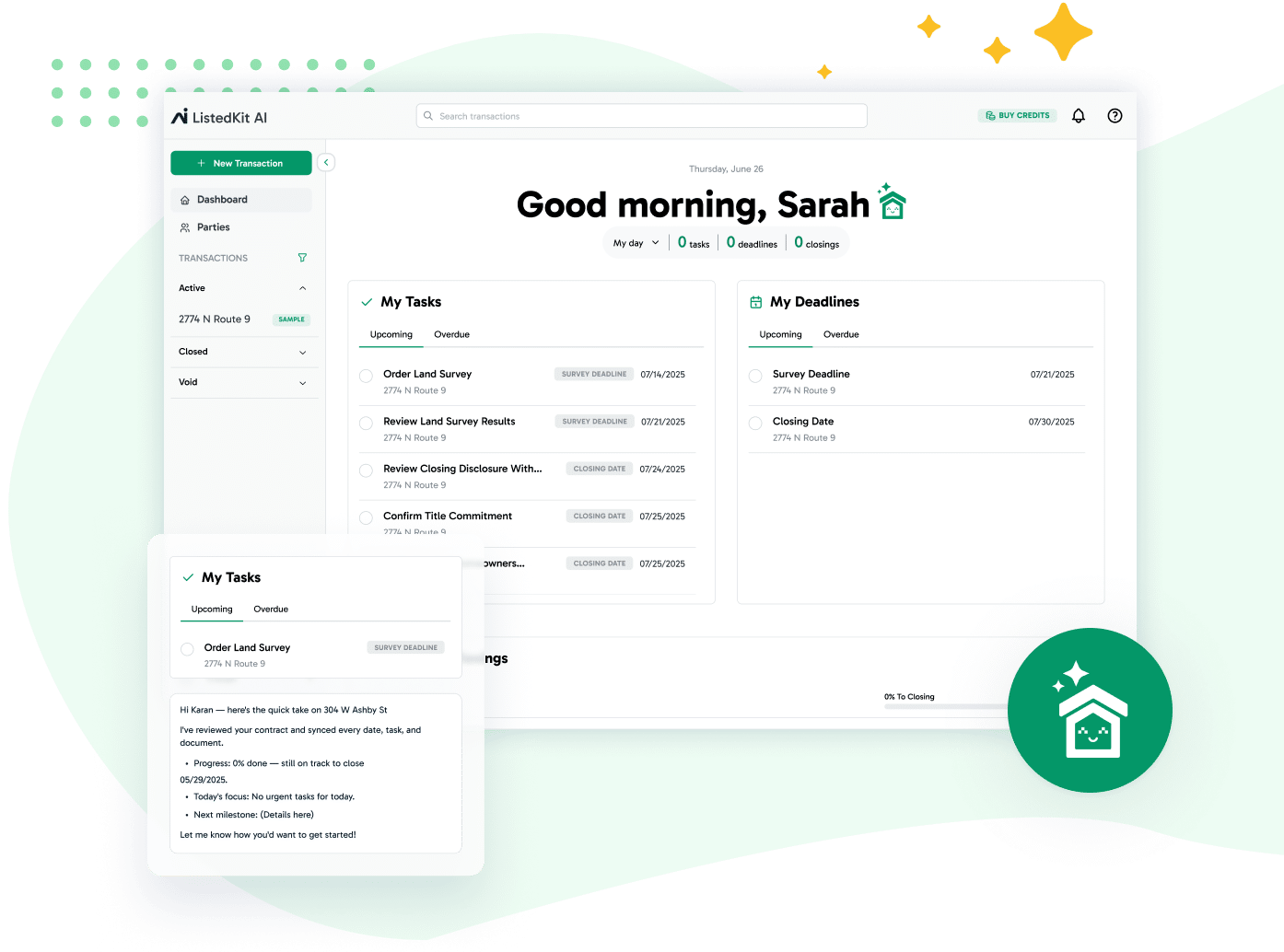

As a transaction coordinator, one of your main tasks is handling paperwork for agents. You probably advertise that you will take the paperwork off their plate! With this, comes a need for accurate record-keeping. I always recommend transaction coordinators to have their own transaction management system for document storage and record-keeping. But if you’re just starting out and don’t have a high volume of work to justify a transaction management system, you will still want to have systems in place of what documents you keep, where to store them, and for how long. Make sure to reference state guidelines for how long agents and/or brokerages are required to keep documents available.

Additionally, I recommend having an organized naming system for documents. It’s common for agents to call months later about a document and you want to be able to locate it quickly and easily. In addition to your own record keeping, you will also likely need to upload everything to the brokerage’s compliance systems. The brokerage will approve documentation based on their standards, and you/the agent will be able to continue to access the documentation here as well.

As a third backup, I would recommend also providing the agents themselves with a set of records. Often, agents will change brokerages, and moving around document records can be time-consuming and messy. To help with this, I recommend uploading all of the transaction documents to the agent’s signature software or providing your clients with a zip file of the transaction documents after closing so they may store them in their preferred location.

Lastly, as a transaction coordinator, you may come across sensitive information from time to time. Have a plan in place for handling secure or sensitive information that you may come across. This is something you will want to practice and also be able to communicate to clients or potential clients.

Client Service Agreements

It is imperative that you have a signed agreement in place with your clients. I know, I know! They often want to get started ASAP and most of the time, things work okay using the honor system. However, if you want to protect your TC business as much as possible, having a clearly defined agreement with your customers is key. Your client service agreement should outline what services you offer, pricing, terms of payment, who is responsible for what, and all the other terms and conditions of your services. I recommend drafting this up and having it reviewed by your lawyer. If you don’t know where to start, there are some templates available online. Remember, this is to protect you and your business, but also, setting expectations upfront is helpful for the clients too.

On that note, let’s dive into setting up expectations for your clients.

Client Expectations

As a transaction coordinator, you may offer a variety of services. The most common are typically contract-to-close services, listing coordination services, and compliance or paperwork management services. Below, we’ll go into a little more detail about what these services are, and why they are important.

Compliance or Paperwork Management Services

Compliance services are typically a paperwork-only service. At almost all brokerages, there is some type of compliance system where documents need to be uploaded and approved by the brokerage. This is a tedious and time-consuming process for agents. As a transaction coordinator, you can take this off their plate. This type of service typically includes gathering, reviewing, and uploading documents. It may also include sending missing items for signature and making sure the file gets the green light of approval from the brokerage. This service often does not include communicating with any parties besides your client.

Listing Services

Listing services often start once the agent has an executed listing agreement in place. The agent has gone out and secured the new listing, negotiated the price, and is working on a marketing plan. Transaction coordinators can step in and start everything else in the pre-listing process–which often includes paperwork review and management, scheduling appointments such as photography, gathering disclosures, keeping sellers abreast of their next steps, and inputting the listing into the agent’s systems.

Contract-to-close Services

Contract-to-close services are what most people think of when they think of your role as a transaction coordinator. This scope of work typically includes everything from the executed contract through closing and often encompasses everything from the compliance service in addition to liaisoning with other parties of the transaction. For example, you will often communicate with title companies, lenders, other agents, and buyers or sellers. Additionally, you will likely be managing transaction deadlines, coordinating paperwork, checking on loan status, scheduling inspections, closing appointments, and more. This service is extremely helpful to agents as they have a second set of eyes on the file, don’t have to worry about paperwork, and can spend less time inside their email inboxes.

What to Do (and Not to Do) for Clients

We can put all of the wonderful practices from above in place, but it doesn’t matter if we do not stick to our clearly outlined service offerings. However, this does not mean that agents will not ask for more or additional services. This is something you will want to be prepared for in your transaction coordinator business, as it is almost a guarantee that it will come up at some point. Having a plan in place will allow you to say no confidently and gracefully.

When these special requests come up, it can be difficult to say no–we are service providers after all and it is our instinct to keep our clients happy and help them as much as we can! Tempting as it may be, remember that working on tasks outside of your scope increases your liability and also takes up more of your time (and potentially for no additional pay).

My number one tip for saying no is to propose a similar solution. For example, if an agent asks you to help with a repair negotiation, instead of saying, “I can’t do that,” try to spin it by offering something you CAN do. For example, tell the agent, “You will be the main contact for the clients during the repair negotiations, but as soon as you come to an agreement, I am happy to send the documents out for signature.” This can alleviate the fear of saying no while also offering a solution.

My other tip for saying no is a play-off the last tip but more so with timing. For example, agents will often ask if you can prepare purchase documents. Instead of saying, “I can’t do that,” try saying, “Our services begin as soon as we have an executed contract. Once you have that, send it over to me and I will get started ASAP.”

These points reiterate why having a client service agreement that clearly defines each party’s expectations is so important. It can also help you feel more confident to say no when you know they signed your agreement and these services they are requesting are not a part of it.

Closing Thoughts

In most transaction coordinator businesses, the liability and responsibility of the overall transaction falls on the agent. As the TC, you are there to assist them with your set tasks to the best of your ability. The agent should be making all major decisions about the transaction and having those conversations with the buyers and sellers. Don’t be afraid to escalate a situation to your agent if something seems wrong or if you are unsure of what to do!

By taking the above steps, you will not only protect your business but will have systems in place to work efficiently and scale your business. You will also have set clear expectations with your clients, which leads to fewer misunderstandings and an overall better working relationship.

Happy TC’ing!

Allyson Kurak

Transaction coordinator and owner of Stitched Real Estate, LLC.

Have an expert tip to share with other real estate professionals? Message [email protected] and let us know. We’d love to feature you in our next article!