Your intelligent AI assistant

for real estate transactions

Manage multiple deals with confidence. Chat with Ava, draft emails, and focus on what matters today.

This has transformed the way coordinators work. The intuitive features and smart automation save me valuable time. I'm excited to see how this will continue to transform my workflow

ListedKit AI is a game changer for real estate transactions. It simplifies transaction management, keeps everyone in the loop, and saves us a ton of time. Highly recommend for any real estate team or solo agent looking to streamline their workflow - this tool makes a big difference.

ListedKit AI has been a game changer for my business. It's like having a super fast second set of eyes on my documents. And even the humans are awesome! Karan gives Ava a run for its money!! Thanks for always being there!

I've been searching for an affordable and comprehensive program to ease the load that we're under. I've found this with ListedKit AI. Very easy to use and rings all the bells and whistles we need!

Transaction Management, Reimagined.

Handle More Deals.

Deal with Fewer Headaches.

Comprehensive AI-powered transaction management with intelligent contract analysis, automated timelines, and seamless team collaboration.

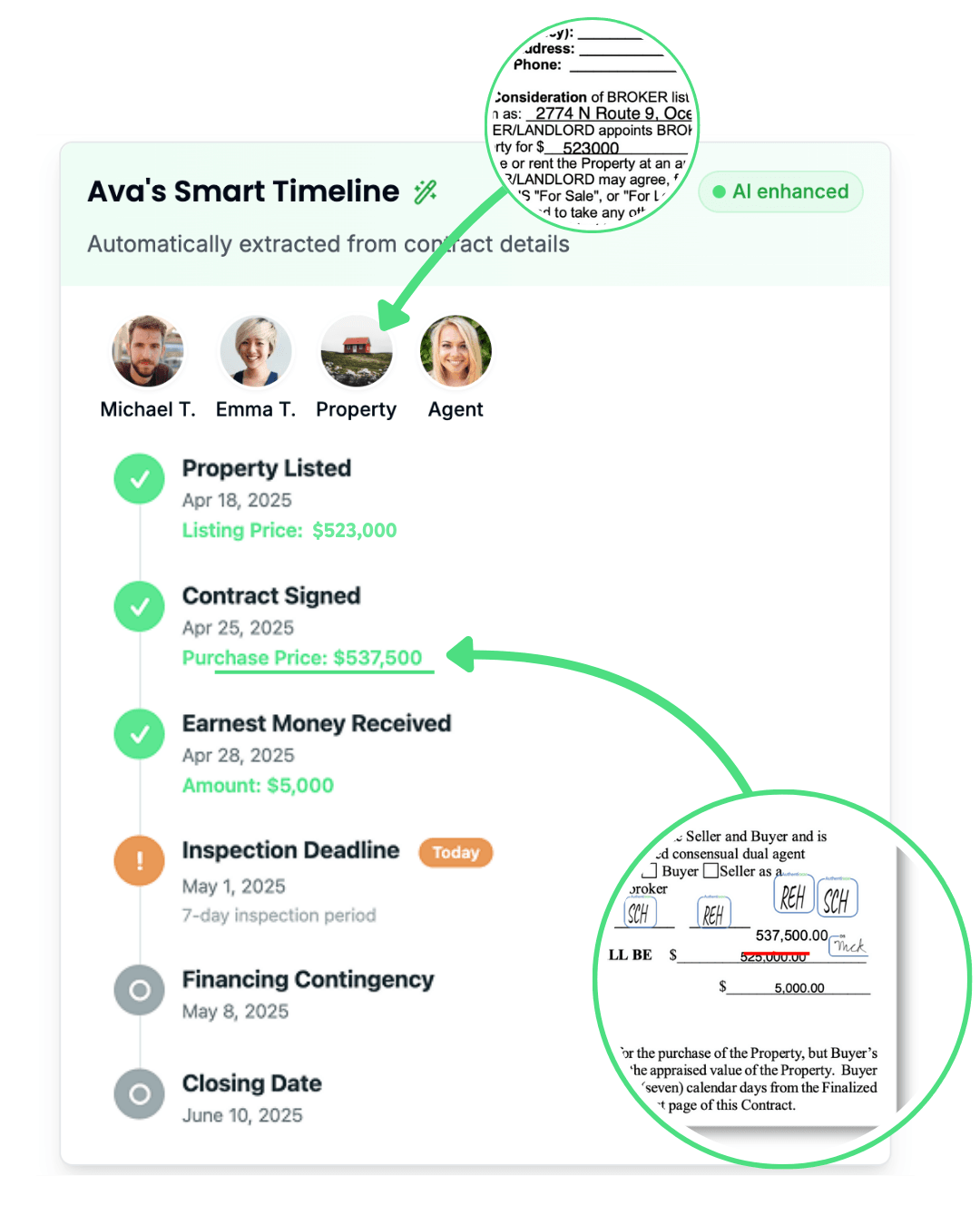

Intelligent Contract Analysis

Automatically extract key information from purchase agreements, addendums, and counter offers.

Dynamic Timeline Management

Auto-generate contract-specific deadlines and sync with your Google Calendar.

Smart Task Management

AI-generated task lists based on contract details and transaction type.

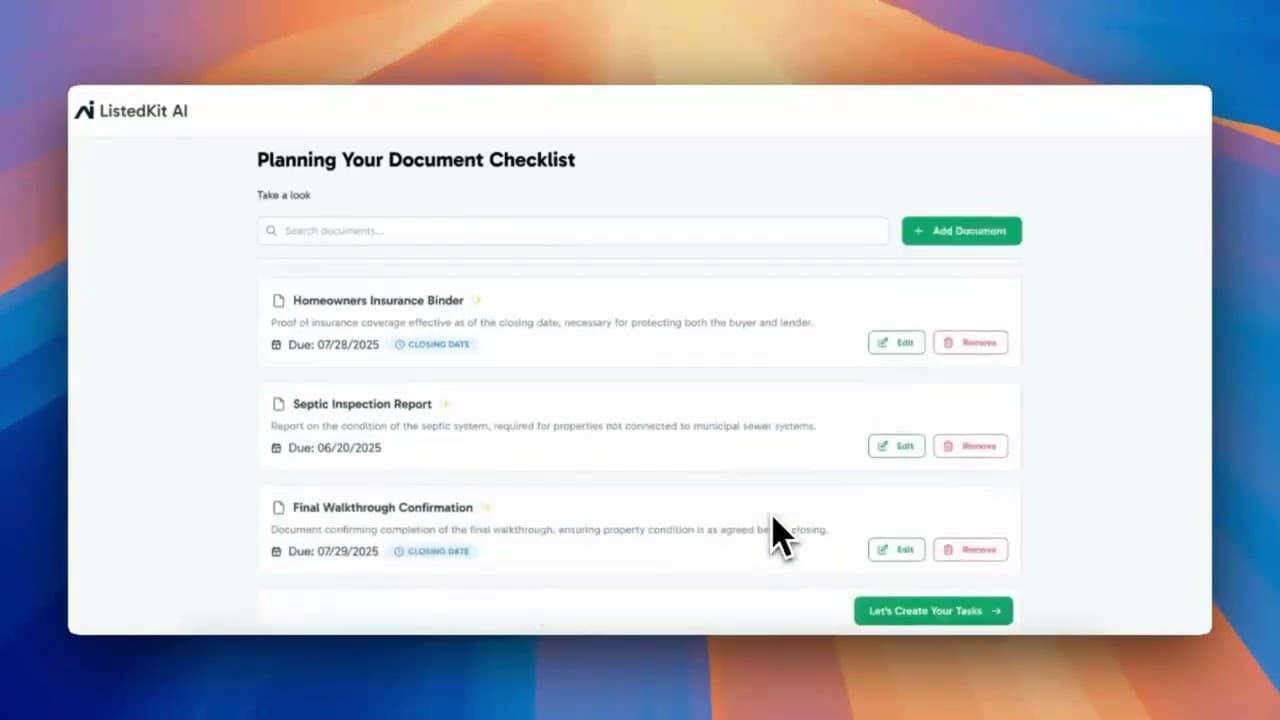

Document Intelligence

Upload inspection reports, loan docs, insurance notices — any document. Ask Ava questions and get immediate answers, summaries, and task suggestions.

Task Reminders

Ask Ava to remind you of important tasks or deadlines. Get professional email notifications and in-app alerts with full context.

Communication Hub

Draft professional emails with transaction details, Gmail integration, and smart scheduling.

Email Templates

Save your best messages as reusable templates with smart placeholders. One-click insertion when composing emails.

Team Collaboration

Multi-user access with role-based permissions and shared contact database.

Email Scheduling & Automation

Draft emails now and schedule them to send at the perfect time. Maintain professional communication timing while staying responsive.

Accuracy & Consistency

Eliminate manual data entry errors. No more copy/pasting transaction details into emails or manually adjusting task deadlines.

How It Works

From chaos to clarity in three simple steps

Upload Your Contracts

Import deals directly

Ava Analyzes Everything

Dates, contingencies, and requirements automatically extracted

Get Daily Priorities

Start each day with exactly what needs your attention

Trusted by leading real estate professionals

What You Can Do With Ava

From intelligent contract analysis to team collaboration - see how Ava transforms your entire transaction workflow

Contract Analysis

Ava, can you analyze this purchase agreement and extract all the key dates and milestones?

Can you process this addendum and update the existing timeline automatically?

Ava, I just got a new listing agreement signed. Can you extract the key details and set up the listing management workflow?

Task Management

I just finished the appraisal scheduling and got the inspection report uploaded. Can you check these off my task list?

The Johnson buyers just asked for a second walkthrough before closing. Can you add that to my task list with a deadline of Thursday?

Communication Hub

Draft an email to the lender requesting a status update on the loan application.

Send a transaction summary to all parties with the current status and next steps.

Draft a closing reminder email for next Friday's closing and schedule it to send Thursday morning at 9am.

Team Collaboration

Sarah is out sick today and the Miller closing is Friday. I need to reassign all her tasks to myself so I can handle everything directly. Can you move them all over to me?

Document Intelligence

What are the major issues in this inspection report?

Summarize this loan application and add the requirements as tasks.

Include the key points from this warranty deed in an email to the attorney.

Timeline & Calendar

The Peterson contract just got amended - closing moved from March 15th to March 22nd. I need to update the timeline and sync all the new deadlines to my calendar. Can you handle this and make sure everyone gets the updated schedule?

What Our Users Say

Real feedback from real estate professionals

"This has transformed the way coordinators work. The intuitive features and smart automation save me valuable time. I'm excited to see how this will continue to transform my workflow"

"With the advent of AI, I've been searching for an affordable and comprehensive program to ease the load that we're under. I've found this with ListedKit AI. Very easy to use and rings all the bells and whistles we need!"

"ListedKit is the most in tune real estate transaction coordination system I've ever seen."

"ListedKit's AI intake pulled my Hawaii contracts and built accurate timelines in minutes. The PDF timeline summaries, Google Calendar sharing, and smart email templates cut my weekly update work dramatically—exactly what I need to manage 60+ escrows."

"ListedKit AI is a game changer for real estate transactions. It simplifies transaction management, keeps everyone in the loop, and saves us a ton of time. Highly recommend for any real estate team or solo agent looking to streamline their workflow - this tool makes a big difference."

"Setup was minimal. Ava learns my task lists and keeps everything moving. I'm in Michigan and even with our forms, it handled the details well. This is exactly the kind of automation that saves hours and lets me focus on clients."

"ListedKit AI has been a game changer for my business. It's like having a super fast second set of eyes on my documents. And even the humans are awesome! Karan gives Ava a run for its money!! Thanks for always being there!"

"This has transformed the way coordinators work. The intuitive features and smart automation save me valuable time. I'm excited to see how this will continue to transform my workflow"

"With the advent of AI, I've been searching for an affordable and comprehensive program to ease the load that we're under. I've found this with ListedKit AI. Very easy to use and rings all the bells and whistles we need!"

"ListedKit is the most in tune real estate transaction coordination system I've ever seen."

"ListedKit's AI intake pulled my Hawaii contracts and built accurate timelines in minutes. The PDF timeline summaries, Google Calendar sharing, and smart email templates cut my weekly update work dramatically—exactly what I need to manage 60+ escrows."

"ListedKit AI is a game changer for real estate transactions. It simplifies transaction management, keeps everyone in the loop, and saves us a ton of time. Highly recommend for any real estate team or solo agent looking to streamline their workflow - this tool makes a big difference."

"Setup was minimal. Ava learns my task lists and keeps everything moving. I'm in Michigan and even with our forms, it handled the details well. This is exactly the kind of automation that saves hours and lets me focus on clients."

"ListedKit AI has been a game changer for my business. It's like having a super fast second set of eyes on my documents. And even the humans are awesome! Karan gives Ava a run for its money!! Thanks for always being there!"

Simple, Transparent Pricing

Pay only for what you use

No subscriptions, no monthly fees. 1 credit = 1 intake. Credits never expire.

How many credits do you need?

No commitment required. First intake is free.

Only pay for what you actually use. 1 credit = 1 intake, and credits never expire, so you can work at your own pace. No wasted money on unused monthly allowances or surprise overages.