As a real estate business owner, spending all your time and effort on a single source of income can be risky. Economic downturns, shifting market conditions, and changing customer preferences can all impact your primary source of revenue.

This article explores practical, real-world strategies to help TCs build multiple revenue streams.

Why Transaction Coordinators Should Consider Diversifying Income

Having a single flow of income limits your potential and increases your vulnerability. Different avenues to create revenue open new options and build a business resiliently. Here are the major beneficial features of diversification:

- Financial Stability. Diversified income streams establish a cushion against the business’s peaks and troughs that might occur due to prevailing trends.

- Skill Development. Gradually increasing your service product range will sharpen your key competencies and make the agents indispensable.

- Career Prospects. Diversifying will also help you sell service products to new customer segments, such as commercial clients, attorneys, or FSBO sellers.

Diversifying does not have to mean transforming your business model overnight. It could be more about offering small, scalable services that align with your expertise and steadily expanding your offerings.

Types of Revenue Streams for TCs

Below are five practical income streams that can work best for transaction coordinators like you. Let’s discuss each in detail.

1. Offering Contract-to-Close Services for FSBO Clients

“For Sale By Owner” (FSBO) sellers often manage their property transactions independently.

While this saves them money on agent commissions, many are overwhelmed by the paperwork, timelines, and legal requirements.

This creates an opportunity for you as a transaction coordinator to step in and offer professional contract-to-close services.

Startup Requirements

- Marketing Materials. Develop clear, professional brochures or flyers that explain your services. Highlight benefits like saving time and avoiding mistakes.

- Training. Invest in FSBO-specific training. Learn how to handle seller disclosures, escrow timelines, and legal documents unique to FSBO transactions.

Pricing Strategy

- Transaction-Based Revenue. Charge a straightforward fee, such as $1,000 per transaction, which FSBO sellers can easily budget for.

- Tiered Packages. Offer multiple service levels. A basic package might include document preparation, while a premium option could cover everything from contract review to closing day coordination.

Real-World Tips

- Network with FSBO sellers through local community boards or online groups. Many are actively seeking help.

- Offer a free consultation to explain your services and build trust.

- Use online tools to track deadlines and tasks, giving clients peace of mind.

By positioning yourself as a reliable partner for FSBO sellers, you can tap into a growing market while generating additional income with minimal startup costs.

2. Transaction Coordination for Commercial Real Estate

Commercial real estate transactions differ significantly from residential ones. As a transaction coordinator, expanding into this market requires specialized knowledge but offers substantial revenue opportunities.

How It Differs to Residential Real Estate Transactions

- Contract Complexity. Commercial deals include intricate terms such as lease agreements, zoning regulations, and tenant rights.

- Longer Timelines. Transactions may take months, requiring close monitoring of progress and deadlines.

- Stakeholders. You’ll work with brokers, property owners, and corporate entities instead of individual buyers or sellers.

- Target Audience. Commercial clients are businesses, investors, or developers focused on return on investment and property potential, unlike residential clients who prioritize personal or family needs.

Requirements

- Certifications. Consider obtaining additional training or certifications in commercial real estate. This ensures you can confidently handle contracts and compliance.

- Knowledge Base. Develop expertise in lease agreements, brokerage fees, and regulatory guidelines. Resources such as online courses or mentorship from experienced professionals can help.

Pricing Strategy

- Percentage-Based. Charge a percentage of the transaction value, typically 0.5% to 1%. For example, on a $1 million deal, your fee could range from $5,000 to $10,000.

Real-World Tips

- Start by offering your services to smaller commercial transactions to gain experience.

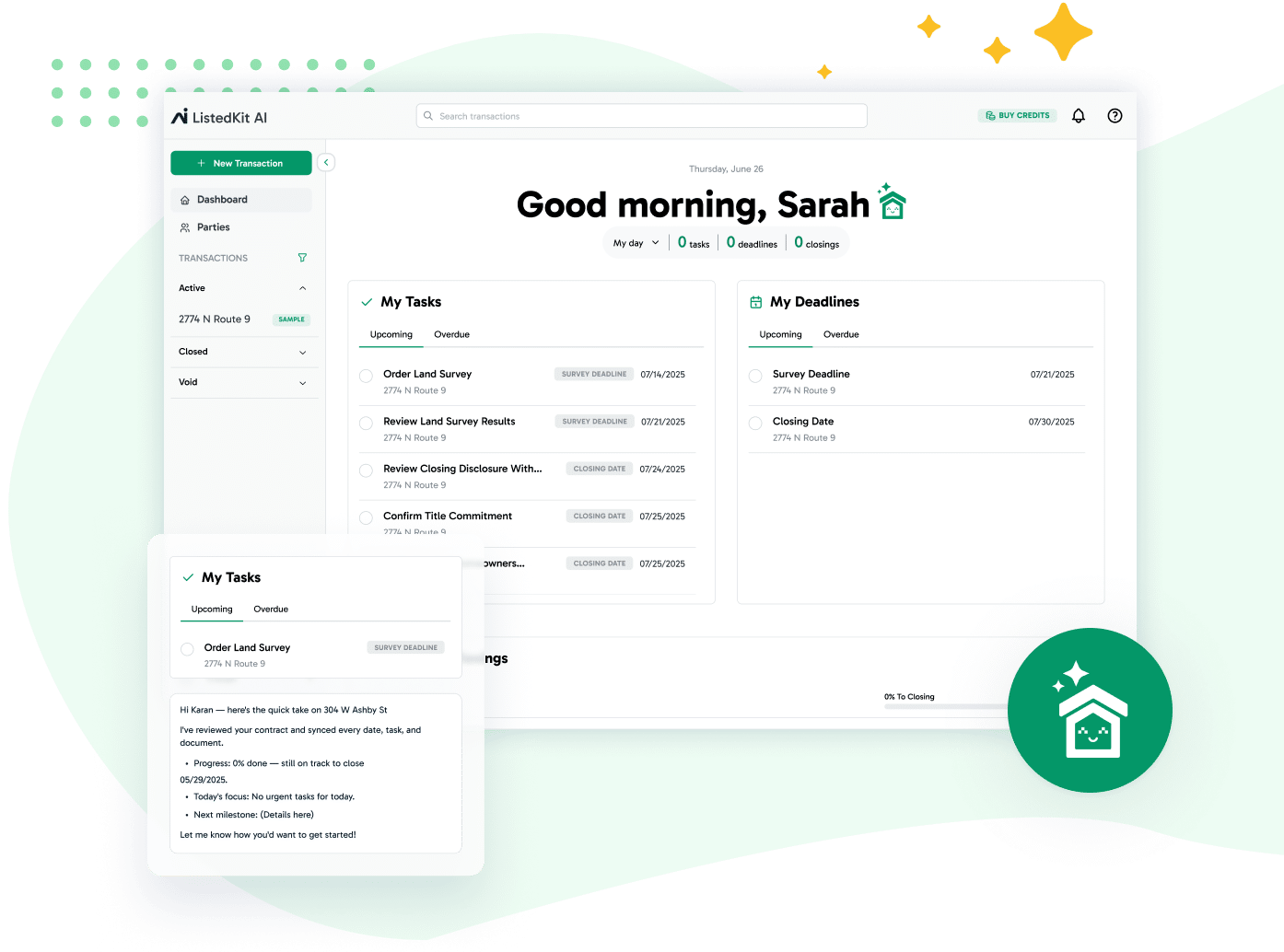

- Use tools like ListedKit to manage project milestones and communicate with multiple stakeholders efficiently.

Expanding into commercial real estate adds a valuable revenue stream while positioning you as a knowledgeable service provider in a lucrative market.

3. Providing Real Estate Administrative Services

Real estate agents often outsource these time-intensive tasks to focus on revenue-generating activities.

By stepping into this role, you create an ongoing income stream while becoming a trusted partner in their operations.

Whether organizing CRMs or sending timely follow-ups, your support keeps their businesses running smoothly.

Examples of Services

As a transaction coordinator, you can take on tasks like:

- CRM Management. Update contact information, track leads, and organize client interactions.

- Scheduling. Arrange property showings, meetings, and client calls to keep agents on track.

- Email Follow-Ups. Send reminders, follow-ups, or thank-you notes to clients and prospects.

- Data Entry and Marketing Prep. Input transaction details into systems or prepare marketing materials such as flyers and property descriptions.

Pricing Strategy

- Hourly Rates. Charge $25–$50 per hour, depending on the service complexity.

- Monthly Retainers. Offer consistent support with packages starting at $500/month for basic tasks or scaling up for comprehensive services.

These tasks can become reliable revenue sources, providing consistent income while helping agents focus on their priorities.

4. Real Estate Compliance Auditing

Compliance auditing is a specialized service that helps real estate professionals meet legal and regulatory requirements. Offering this service can create a steady income stream while providing a critical resource for brokers, agents, and property owners.

What It Involves

- Document Review. Examine contracts, disclosures, and agreements to identify errors or missing information.

- Regulatory Checks. Ensure all documents align with federal, state, and local real estate laws.

- Reporting. Provide detailed summaries of findings and recommend corrective actions to clients.

Requirements

- Legal Expertise: Gain a thorough understanding of real estate laws and compliance standards.

- Tools: Use auditing checklists and document management software to streamline your process.

- Training: Consider courses or certifications on real estate compliance to build credibility and improve your skills.

Pricing Strategy

- Per Audit: Charge a flat fee, such as $250–$500 per audit, depending on the transaction complexity.

- Subscription Model: Offer ongoing compliance support for brokers or agencies, with monthly fees ranging from $1,000 to $2,500.

Real-World Tips

- Partner with brokerage firms to become their go-to compliance service provider.

- Develop templates and standardized processes to handle audits efficiently.

- Use tools like ListedKit to organize documents and track audit progress.

Real estate compliance auditing positions you as a trusted resource while generating consistent income. It’s an excellent service for TCs looking to expand their expertise and attract long-term clients.

5. Training and Mentorship Programs for Aspiring TCs

Sharing your expertise through training and mentorship is a rewarding way to build an additional income stream.

Aspiring transaction coordinators (TCs) are eager to learn the skills and best practices needed for success, and you can help them while generating passive income.

Benefits

- Knowledge Sharing. Help new TCs build confidence and skills.

- Passive Income. Create resources like courses or subscription memberships that earn money over time.

- Industry Impact. Contribute to professionalizing the TC role by mentoring the next generation.

Requirements

- Course Material: Design and develop beginner-friendly guides, templates, and checklists covering the basics of transaction coordination.

- Webinars: Offer live Q&A sessions or training webinars to engage with learners.

- Workshops: Provide one-day virtual or in-person workshops for hands-on training.

Pricing Strategy

- Course Fees: Charge a one-time fee, such as $200–$500 per course, depending on the depth of the material.

- Membership Subscriptions: Offer access to ongoing resources, exclusive webinars, and community support for a monthly or yearly fee ranging from $30–$100.

The demand for skilled TCs is increasing, and many entering the field are seeking accessible training options. By offering mentorship programs and courses, you establish a scalable revenue stream while positioning yourself as a leader in the industry. Your expertise can make a significant difference, generating passive and consistent income with minimal effort after setup.

Expanding your services requires strategic positioning and thoughtful pricing to attract and retain clients.

Building a Marketing and Pricing Strategy

Marketing and pricing for new services and diversified income streams as a transaction coordinator require a thoughtful approach.

A strong strategy will attract new clients and ensure that your efforts are aligned with the goals of your business. Here’s how to position yourself effectively in the market:

Tips for Marketing Your Services

- Highlight Your Expertise. Through blog posts, social media, and webinars, establish credibility in new service areas.

- Personalize Your Message. Address your customers directly and show them how your services will help solve their particular problems.

- Showcase Client Testimonials. Display positive feedback from previous clients to help build trust and demonstrate your value.

Pricing Strategies

- Competitive Pricing. Research the average revenue for similar services in your market to avoid undervaluing your work.

- Bundling Services. Package complementary services, like administrative support and transaction coordination, into appealing customer packages.

For example, a discounted compliance auditing and contract-to-close service bundle could attract real estate professionals seeking comprehensive support.

With a well-rounded marketing and pricing strategy, you can effectively expand your service offerings while meeting the needs of a broader client base.

Tools and Resources to Simplify Your Expansion

Diversifying your revenue streams requires the right tools and resources to maintain efficiency and customer satisfaction.

Recommended Tools

- ListedKit. A transaction management software designed for TCs to manage multiple services seamlessly.

- Time Trackers. Tools like Toggl to monitor productivity and ensure profitability.

- Templates. Standardized documents for services like compliance auditing or FSBO coordination.

Learning Resources

- Certifications: Industry-specific training programs to deepen your expertise.

- Online Courses: Platforms like Udemy or Coursera for mentorship program development or commercial real estate knowledge.

Final Thoughts: Take the First Step Towards Diversification

Diversifying your income as a transaction coordinator helps you build financial stability, expand your skills, and grow your business. By offering additional services, you can meet client needs while creating new sources of revenue.

- Contract-to-Close Services for FSBO Clients: Help sellers without agents handle documents and timelines, a growing niche in the real estate market.

- Transaction Coordination for Commercial Real Estate: Manage larger and more detailed transactions, which often bring higher fees.

- Real Estate Administrative Services: We handle time-consuming tasks like scheduling and email follow-ups, freeing up agents for their core work.

- Real Estate Compliance Auditing: Review contracts and documentation to ensure accuracy and compliance, addressing a critical need for brokers and agencies.

- Training and Mentorship Programs for Aspiring TCs: Share your expertise while generating passive income through courses, workshops, and mentorships.

Start small by focusing on one or two services that match your skills and interests. Over time, build on your success to create a sustainable, profitable business.

Subscribe to our newsletter for more practical tips and expert guidance to help you grow your transaction coordination business.