Becoming a certified transaction coordinator lets you turn your real estate experience into a structured and rewarding business.

This could be the perfect career shift if you enjoy managing paperwork, tracking deadlines, and keeping deals on schedule.

This guide walks you through every step of the process—from training and pricing to setting up your business and finding clients. You’ll have a clear roadmap to start your journey as a certified transaction coordinator by the end.

Step 1: Get Familiar with the Role of a Transaction Coordinator

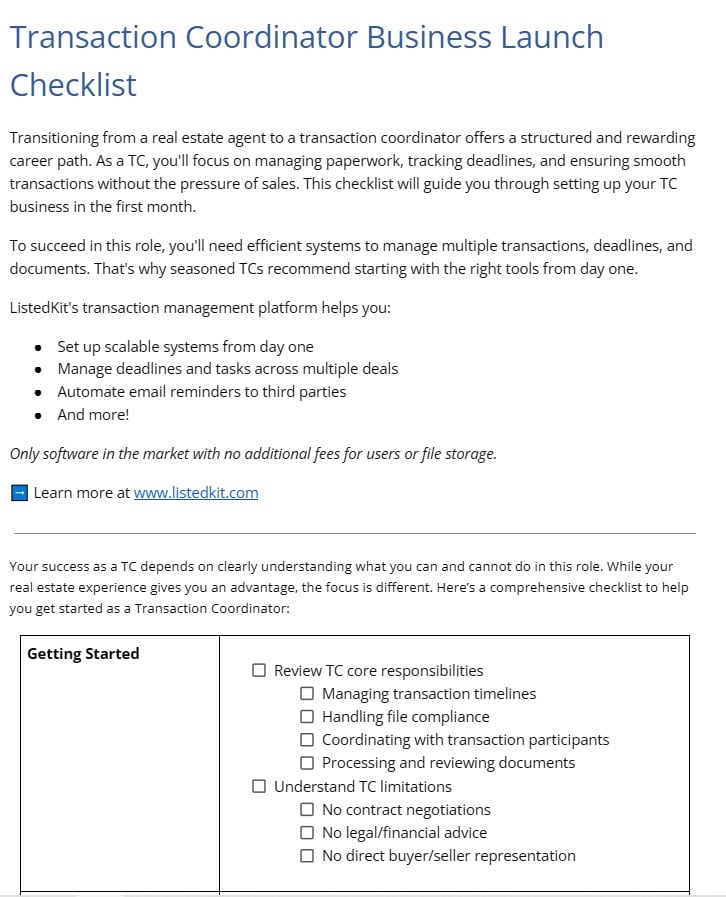

Shifting from agent to transaction coordinator is about leaving direct sales work behind and keeping real estate transactions clean and compliant.

Instead of closing deals or exploring new opportunities, you will manage paperwork, timeliness, and communication, ensuring transactions run smoothly from contract through close.

| What TCs Handle | What TCs Don’t Do |

| Managing transaction timelines. Track key deadlines like contingency removals, inspections, and financing approvals. | Negotiate contract terms. Only licensed agents or attorneys can discuss pricing, contingencies, or repairs with clients. |

| Handling file compliance. Organize and verify all required real estate documents to meet brokerage firms and state regulations. | Provide legal or financial advice. TCs cannot interpret contracts or explain mortgage loan details. |

| Coordinating with key transaction participants. Work with escrow officers, lenders, and real estate agents to prevent delays. | Communicate directly with buyers or sellers in a representative capacity. You can relay information but cannot act on behalf of an agent. |

| Reviewing and processing documents. Check contracts for missing signatures and manage amendments. |

When shifting into this role, your real estate experience gives you an advantage, but you must remember that being a TC requires a different focus.

Step 2: Making the Choice Between Pursuing a License or Certification

Most states do not require licensure for TCs. However, some regulate the handling by non-license professionals for some functions for transactions. For instance:

- Some states allow unlicensed transaction coordinators to provide administrative support for things like tracking deadlines, filing paperwork, and communicating with escrow.

- Other states prohibit unlicensed assistants from explaining terms of the contract, negotiating for repairs, or doing work that can be perceived as real estate representation.

It’s always best to work under the ambit of a TC and not engage in a broker’s work unless one has some sort of understanding with the broker or the agency.

This is for the sake of being legally compliant and for agents and transaction coordinators alike to maintain their core competencies. To understand the limitations of unlicensed TCs, check the NAR list of state regulations for unlicensed assistants and your state’s real estate commission guidelines.

Should You Get a Transaction Coordinator Certification?

Even though licensing may not be required, certifications can help build your expertise and credibility.

Many real estate agents prefer working with trained TCs who understand file compliance, legal requirements, and the transaction process in depth.

Here’s why certification programs like the Certified Transaction Coordinator (CTC) in California or nationally recognized courses from NAR provide valuable training:

- They help you understand real estate laws, brokerage policies, and contract management.

- They can make you more appealing to real estate brokerages, teams, and agents looking for experienced TCs.

- They allow you to sharpen your skills in real estate transaction coordination and learn best practices.

Brokerage Partnerships: Do You Need One?

In certain states, unlicensed TCs may need to limit their services to administrative tasks unless working under a brokerage’s direct supervision.

This allows you to operate legally while handling administrative tasks without overstepping legal boundaries.

Before offering estate transaction coordinator services, make sure you:

- Understand your state’s licensing laws and any restrictions on unlicensed professionals

- Consider getting certified to boost your credibility and knowledge.

- Check whether you need to partner with a brokerage to provide TC services legally.

Taking these steps will set you up for success while keeping you compliant with real estate laws in your state.

Step 3: Training & Education: What You Need to Learn

To become a successful transaction coordinator, you need a strong grasp of real estate laws, administrative roles, and transaction management. Investing in training can help you stand out and build confidence in managing real estate transactions.

The more knowledgeable you are, the better you can confidently handle transactions under contract.

Other than the basics, here are some skills you have to learn to be a skilled TC.

- Contract Management & Legal Compliance. Learn how to manage real estate documents, disclosures, and fiduciary duties to avoid compliance risks.

- Transaction Management Software. Tools like ListedKit help TCs handle document management, electronic documents, and contact with transaction participants more efficiently.

- Communication & Client Relationships. You’ll be the point of contact for agents, lenders, and clients, so strong soft skills are key.

- Professional Development & Industry Knowledge. Staying updated on real estate development training, executive assistant roles, and industry knowledge helps build your expertise.

Step 4: Choosing the Right Pricing Model for Your Transaction Coordination Services

Selecting the right pricing model is critical in building a sustainable transaction coordination business. How you charge for your services affects your revenue, client expectations, and long-term profitability.

Your pricing should reflect:

- The complexity of transactions you handle.

- Your experience level and expertise.

- The real estate market you serve.

- The type of agents and brokerages you work with.

Some real estate agents prefer flat fees, while others seek customized pricing based on transaction volume. Choosing the right model will help you attract clients, prevent overwork, and ensure fair compensation for your time.

Popular Pricing Models for Transaction Coordinators

Each pricing structure has pros and cons, and the best option depends on your business goals and client needs.

1. Flat-Fee Per Transaction

A flat fee per transaction charges a set amount for each transaction, regardless of complexity. This model is transparent and predictable, making it easy for agents and brokerages to budget for transaction coordination services.

Best for: TCs handling a high transaction volume with a standard service offering.

| Pros | Cons |

| Simple pricing | Risk of undervaluation |

| Predictable revenue | No flexibility |

| Easier client conversations | Not ideal for highly specialized services |

2. Tiered Pricing Packages

Tiered pricing allows TCs to offer different service levels, appealing to agents with different needs and budgets. Each package includes more services at a higher price.

Best for: TCs who want to serve different agent types while maintaining a clear pricing structure.

Here’s an example of tiered pricing packages.

| Package Type | Price Range | What’s Included | Ideal Client |

| Basic Package | $300 | Document handling, deadline tracking, compliance checks. | Experienced agents needing minimal support. |

| Standard Package | $500 | All Basic services + client/vendor communication. | Agents needing more administrative help. |

| Premium Package | $800+ | Everything in Standard + marketing support, listing input, and priority service. | High-volume agents and brokerages needing full support. |

3. Retainer Model (Monthly Pricing)

A retainer model offers ongoing transaction coordination support for agents or brokerages who regularly close deals. Agents pay a set fee every month for a predetermined number of transactions.

Best for: High-volume agents and brokerages that need consistent support.

| Pros | Cons |

| Predictable monthly revenue. | Some agents may prefer per-transaction pricing. |

| Encourages long-term partnerships | May lead to undercharging if transaction volume exceeds expectations. |

Example: A TC charges $2,000 per month to handle up to 10 transactions for a busy real estate team.

Step 5: Setting Up Your Business

Before working with real estate brokerages and office managers, make sure your business is legally structured and equipped with the right tools.

Key Steps to Launch Your TC Business

- Register Your Business. Choose between a sole proprietorship, LLC, or S-Corp based on tax benefits and liability protection.

- Open a Business Bank Account. Keep your finances separate for better tracking.

- Create a Service Agreement. Clearly define your transaction coordination scope, pricing, and client responsibilities.

- Invest in Transaction Management Software. Platforms like ListedKit improve efficiency by keeping all files in one place.

A professional setup helps you deliver exceptional service and maintain positive relationships with agents.

Pro Tips for a Smoother Business Registration

Even though you’re already familiar with real estate, shifting to a business owner mindset comes with new responsibilities. Here are a few tips to make your business registration process smoother:

Check Your State’s Business Requirements First

Each state has different rules for business registration, tax filing, and licensing. If you worked under a brokerage before, this may be your first time handling these details yourself.

Look up your state’s Secretary of State website to see what’s required for LLCs or sole proprietorships in your area.

Talk to an Accountant About the Tax Structure

The way you register your business affects how you get taxed. As an agent, you may have worked under a 1099 independent contractor setup, but as a TC, you might benefit from LLC or S-Corp status to protect your personal assets.

A tax professional can help you choose the best structure for keeping more of what you earn.

Get a Business EIN and Set Up Proper Invoicing

Even if you’re a sole proprietor, an Employer Identification Number (EIN) makes it easier to open a business bank account and separate your finances.

Also, an invoice system should be set up early—whether through QuickBooks, HoneyBook, or another platform—to track income and expenses properly.

Step 6: Marketing & Finding Your First Clients

Building a client database requires a mix of networking, content marketing, and direct outreach.

As a former real estate agent, you already have industry connections—now it’s about positioning yourself as a transaction coordinator that agents can rely on.

- Leverage Existing Agent Relationships. Reach out to past colleagues and brokerages, letting them know about your transaction coordination services. Many agents struggle with file compliance and transaction timelines and may welcome the support. Offer a trial service to agents hesitant about outsourcing.

- Build an Online Presence. Update your LinkedIn page to reflect your experience conducting real estate transactions. Having a clean website with your pricing, your services, and your client feedback will make agents comfortable about hiring you. Facebook and Instagram give you the tools you need to engage potential clients by publishing transaction advice and your successes.

- Use Cold Outreach Effectively. Email or message agents with a clear value proposition. Keep it short and direct—explain how you can help them manage transactions more efficiently. Follow up if you don’t hear back.

- Join Real Estate Groups & Industry Events. Participate in Facebook groups, local real estate associations, and industry conferences to meet agents who need support. Being active in these spaces builds trust and credibility.

Step 7: Essential Tools & Resources for a Smooth Operation

Here are the most important tools for TCs:

Transaction Management Software (TMS)

Without a transaction management system, keeping track of deadlines, contracts, and compliance details can quickly become unmanageable.

You need a system that centralizes everything in one place, helping you keep deals on track without constant back-and-forth.

ListedKit simplifies transaction coordination by allowing you to:

- Track transaction timelines so deadlines don’t get missed.

- Store and manage documents securely for compliance and easy access.

- Provide agents with updates without relying on scattered emails.

E-Signature Tools

Every real estate transaction relies on signed documents. When signatures get delayed, deals stall, and agents get frustrated. E-signature tools eliminate these delays by allowing contracts to be signed from anywhere.

Why e-signatures matter for real estate transactions:

- Faster turnaround – No waiting on in-person signings.

- Fewer errors – Ensures documents are completed correctly the first time.

- Convenience for clients – Buyers and sellers can sign from their phones or computers.

Accounting & Invoicing Software

As a transaction coordinator, keeping track of payments, taxes, and income is essential for running a profitable business.

Accounting software helps you:

- Send professional invoices and track payments from agents.

- Monitor business expenses so you know exactly what you’re earning.

- Simplify tax filing by keeping financial records organized.

Your Next Steps to Becoming a Certified Transaction Coordinator

By following the right steps, you can set yourself up for success in real estate transaction coordination. Here’s a quick recap of what you need to do next:

- Gain the right knowledge. Learn about real estate laws, compliance, and contract management through training programs.

- Decide if you need certification. While licensing isn’t required in most states, certifications enhance credibility and help you stand out.

- Choose a pricing model. Determine whether flat fees, tiered pricing, or retainers work best for your client base and income goals.

- Set up your business. Register your company, organize finances, and invest in the right transaction management software like ListedKit.

- Find your first clients. Use your existing real estate connections, online presence, and direct outreach to build your client database.

Becoming a certified transaction coordinator gives you the freedom to manage transactions without the pressure of sales.

Ready to take the next step? Download our free checklist for starting your TC business today!