Real estate transactions generate a massive volume of paperwork, including contracts, disclosures, loan agreements, and inspection reports. Losing or mismanaging these records can lead to compliance violations, financial penalties, and legal disputes.

Without a secure and accessible system, finding old files can feel like searching for a needle in a haystack. Digital storage solutions simplify document retention by automating organization, providing encryption, and allowing easy retrieval.

This guide covers retention requirements, risks of non-compliance, and best practices for secure, long-term storage.

How Long Should You Keep Real Estate Records?

Maintaining proper records is critical for brokerages, compliance officers, and transaction coordinators.

Federal IRS regulations, state real estate commission rules, and industry best practices all influence the length of time different documents should be kept.

Generally, IRS guidelines require keeping tax-related records for three years (with longer periods in certain cases). NAR also mentioned that brokerages have to retain real estate transaction files for three-five years (depending on the state).

The Risks of Non-Compliance: Legal & Financial Consequences

Failing to comply with real estate document retention requirements creates legal risks and financial burdens for brokerages, compliance officers, and transaction coordinators. Missing transaction records can lead to regulatory penalties, lawsuits, and operational disruptions that affect real estate firms.

Legal & Financial Penalties for Poor Record Retention Practices

- State real estate commissions require brokers to retain transaction files for at least 3–5 years, depending on the state. Failure to comply may result in fines, audits, or license suspensions.

- Government agencies overseeing financial transactions may penalize brokerages that mishandle escrow records, closing statements, or trust account funds.

- The Consumer Financial Protection Bureau (CFPB) enforces consumer protection laws that apply to certain financial aspects of real estate transactions, such as disclosures and escrow account management.

Legal Complications & Lawsuits

- Missing purchase agreements, sales contracts, closing disclosures, or lease agreements weakens a brokerage’s legal defense in transaction disputes.

- Lost commission statements or escrow records can lead to disputes with agents, clients, or state regulators.

- Inadequate disclosure retention (e.g., lead-based paint disclosures) can result in legal claims from buyers or tenants.

Potential Audits & Investigations

- State real estate commissions may audit a brokerage’s transaction records, escrow accounts, and disclosure compliance to verify adherence to licensing regulations.

- The IRS may audit a brokerage’s tax filings and payroll records, requiring access to historical financial and commission records.

- Inconsistent or missing earnest money deposit records or escrow reconciliations can trigger trust account investigations.

Business Continuity Risks

- Without a structured document retention policy, brokerages may struggle to retrieve essential transaction records when responding to legal inquiries, audits, or client disputes.

- Inconsistent recordkeeping delays closings complicates regulatory reporting and increases compliance risks.

- Failure to maintain digital backups can result in lost historical transaction data, making verifying past sales or commissions difficult.

By implementing secure document retention policies and effective record management, brokerages, compliance officers, and transaction coordinators can avoid compliance risks while maintaining smooth operations and legal protection.

Digital vs. Physical Storage: Why You Need a Secure and Efficient System

Many brokerages, compliance officers, and transaction coordinators still keep records using paper documents and physical file cabinets

While this method has been the standard for decades, it is not without risks, inefficiencies, and compliance challenges.

A digital document storage system offers better security, efficiency, and ease of access—making it a more effective solution for modern real estate transactions.

Challenges of Physical Storage

Here are common problems with physical storage:

- Storage Space Limitations. Paper records can accumulate quickly, taking up valuable office space. Over time, storing transaction files, escrow records, and lease agreements might require off-site storage, adding extra costs and retrieval challenges.

- Example: If a brokerage with 20+ agents processes hundreds of transactions annually, they might find their storage cabinets filling up quickly. In such cases, they could end up renting an off-site storage unit just to maintain compliance with record retention laws.

- Risk of Loss or Damage. Physical records might be vulnerable to fire, flooding, mold, or theft. If transaction files are lost or damaged, it could lead to compliance failures or legal disputes.

- Example: Let’s say a real estate office experiences a pipe leak, damaging several years’ worth of escrow records stored in a filing cabinet. If those files had been digitized, retrieval might be faster, reducing the risk of compliance violations.

- Difficult Retrieval of Documents. Finding an old transaction file can be time-consuming when relying on manual searches. If a record is misfiled or incomplete, retrieval might take hours or days, delaying legal or compliance processes.

- Example: If a compliance officer needs a five-year-old closing statement for an audit, but the file was misplaced in a crowded storage room, they might spend days searching instead of retrieving it in seconds with a digital system.

Benefits of Digital Storage Solutions

These are the best reasons why you should switch to digital storage:

| Benefit | Description | Example |

| Industry-Leading Security Measures | Most cloud-based document storage provides strong encryption, access controls, and audit logs, which might help protect sensitive real estate records from unauthorized access. | If a brokerage uses a cloud-based document system, access to client transaction records could require multi-factor authentication (MFA), reducing the risk of unauthorized access. |

| Ease of Access & Digital Access Controls | Unlike paper records, digital files are searchable, making retrieval instant and effortless. Access controls might also prevent unauthorized personnel from viewing sensitive data. | Let’s say a broker needs a commission statement from two years ago. With digital storage, they might simply enter the transaction ID in a search bar and retrieve the file in seconds instead of searching through paper files for hours. |

| Automated Backups & Protection Against Data Loss | Cloud storage solutions often provide automated backups to help prevent permanent data loss due to system failures or cyber threats. | If a brokerage’s local server crashes, a cloud-based system might automatically restore the most recent version of all transaction records, preventing disruption. |

When to Use a Hybrid Approach

While digital storage is more efficient, some state laws require keeping original paper copies of certain real estate documents for legal compliance.

A hybrid approach—combining physical copies with digital backups—helps balance accessibility and compliance.

Documents That Might Require Physical Copies:

- Original lease agreements (some states require wet signatures).

- Settlement statements & closing disclosures (state-dependent).

- Certain notarized legal documents (e.g., power of attorney for property sales).

If a state requires original wet-signed lease agreements to be retained for five years, a brokerage might store the paper copies in a fireproof cabinet while scanning them into a cloud system for easy access.

Secure & Compliant Document Retention: Best Practices for Real Estate Transactions

Effective document management strategies protect real estate records, payroll records, and business transactions from unauthorized access and legal disputes.

Best Practices for Secure Document Retention

- Encryption & Access Controls

- Digital files must include access controls that restrict unauthorized access.

- A secure document management strategy prevents document manipulation or data breaches.

- Regular Audits & Version Control

- Regular audits confirm compliance with applicable regulations and detect storage gaps.

- Version control prevents outdated files from being used in legal matters.

- Automated Document Retention Schedules

- Set up document retention guidelines that automatically archive digital records and electronic documents.

- Establish legal document disposal of records policies for expired retention periods.

- Integration with Transaction Management Platforms

- Electronic document management systems such as ListedKit help brokerages and TCs store real estate records securely.

Choosing the Right Digital Document Storage Solution

Selecting the right digital storage solution helps brokerages, compliance officers, and transaction coordinators maintain legal compliance, operational efficiency, and ease of access.

A well-designed system should streamline transactions, improve security, and simplify document retrieval, allowing real estate professionals to focus on deals rather than paperwork.

Key Features of a Reliable Document Storage System

Legal Compliance & Protection Regulations

- Solutions must comply with state-specific regulations and federal data protection laws to prevent legal risks.

- Platforms should follow secure document handling standards like encryption, audit trails, and permission-based access.

- Automated compliance tracking helps brokerages maintain accurate record retention schedules, reducing the risk of missing or misplacing transaction files.

Efficient Retrieval & Organization

- Use smart indexing features to categorize documents by record type, transaction stage, and retention period, ensuring quick access.

- AI-powered contract extraction automatically identifies key transaction details (e.g., closing dates, commission amounts, contract deadlines) and maps them to the correct file.

- Smart tagging and metadata tools improve search functionality, allowing users to locate documents instantly by entering client names, dates, or property addresses.

Scalability & Cost Efficiency

- Cloud-based storage minimizes physical storage space needs and reduces off-site document retention costs.

- Platforms should offer unlimited storage options while maintaining strong version control and access management.

- Automated workflows allow transaction files to move seamlessly from offer acceptance to closing, reducing administrative work and improving efficiency.

Managing Transaction Files with ListedKit

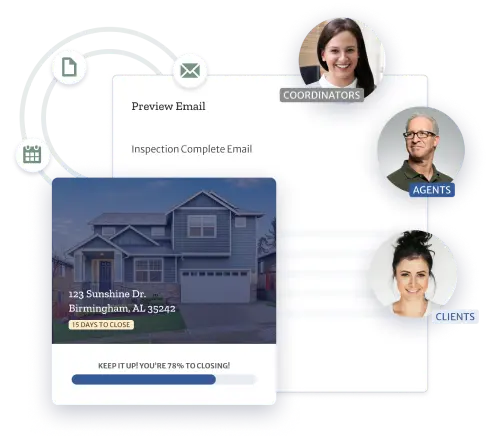

ListedKit simplifies transaction management by keeping documents organized and accessible throughout the closing process.

It allows brokerages and transaction coordinators to store and share essential files within an active transaction, ensuring that all stakeholders have easy access to the most up-to-date documents.

- Efficient File Management. Upload, organize, and share documents within an active transaction.

- Task-Linked Documentation. Attach key documents to specific tasks, keeping workflows structured.

Collaborative Access. Ensure team members and clients have the right files at the right time.

Keep Transaction Files Organized with ListedKit

Stay on top of every file with task-linked documentation and real-time access.

Long-Term Document Storage Solutions

Although software like ListedKit keeps transaction files organized during active deals, keeping documents safe for the long term needs a reliable storage solution that meets compliance and regulatory standards.

Some cloud-based storage providers that we recommend are Google Drive, Dropbox, and OneDrive, as they offer:

- Encrypted Storage. Protect sensitive transaction records from unauthorized access.

- Permission Controls. Restrict access to only approved team members, clients, and compliance officers.

- Automatic Backups. Ensure that archived documents remain intact, even if a local system fails.

Secure Access & Document Retrieval: Making Records Easy to Find

A comprehensive record retention policy includes efficient retrieval of documents while protecting against unauthorized access.

Key Strategies for Secure Record Retrieval

- Indexing & Metadata Tagging

- Assign document types, employment records, and business contracts searchable keywords.

- Standardize naming conventions for consistency.

- User Permissions & Compliance Logs

- Restrict access to financial documents, estate planning documents, and payroll records.

- Enable activity logs to monitor who accesses sensitive files.

- Mobile & Remote Access for Agents & Brokers

- Use secure cloud storage for instant remote access to real estate and loan documents.

- Enable two-factor authentication (2FA) for added protection.

These strategies improve document storage, legal compliance, and operational efficiency in modern real estate businesses.

Protect Your Business with Smart Document Retention Strategies

Organizing and securing real estate transaction records protects brokerages, compliance officers, and transaction coordinators from legal risks, audits, and operational setbacks.

Most state real estate commissions require keeping transaction files for at least 3–5 years, while some documents may need longer retention for tax and legal purposes.

Key Takeaways:

- Use digital storage solutions for better security, accessibility, and efficiency.

- Back up critical records automatically to prevent data loss.

- Limit access to sensitive files using encryption, permission settings, and compliance logs.

- Adopt a hybrid approach to retain physical copies of legally required documents.

Keep real estate transaction files organized throughout the closing process. Explore your options with ListedKit.