Building an SOP for setting up transaction files is essential to improving your transaction efficiency. This involves organizing, categorizing, and preparing every essential document that tracks a property sale from the initial agreement to the closing stage.

These files include client information, property data, legal forms, inspection reports, and task lists—all of which must be systematically managed to keep the transaction process smooth, compliant, and professional.

In this guide, we’ll cover the core elements of a transaction file setup SOP, from document categorization to task flow sequencing. We’ll also provide detailed guidelines for organizing files, managing data entry, and creating actionable checklists. Lastly, we’ll provide some prompts you can use to create your own SOP with ease.

Core Elements of a Transaction File Setup SOP

Creating an effective SOP for real estate transaction files starts with defining the core elements that guide the setup process. These elements, when clearly outlined in your SOP, allow real estate TCs to manage complex tasks and maintain quality standards across all client interactions.

1. Document Categories and Hierarchical Folder Structure

A well-structured document category system is essential in SOP documentation, enabling TCs to quickly locate files, verify information, and ensure regulatory compliance. Categorizing files by type not only facilitates adherence to industry standards but also helps maintain clarity in complex processes. Common document categories include:

- Legal Documents: Includes contracts, disclosures, and addenda, which must follow specific regulatory requirements.

- Client-Specific Files: Information like client contact details and signed agreements, required for direct interactions and follow-ups.

- Property-Specific Files: Items such as inspection reports, appraisal results, and environmental assessments, relevant to the property itself.

A hierarchical folder structure within these categories adds another layer of organization. For example, the primary folder might be labeled with the client’s name or the property address, while subfolders organize specific document types. This “top-down” approach ensures that everything is in its rightful place, accessible in seconds rather than minutes.

Example: A property file may look like this:

- Main Folder: 123_MainSt_Transaction

- Subfolder 1: Legal_Documents

- Subfolder 2: Property_Reports

- Subfolder 3: Financials

- Subfolder 4: Closing_Documents

This level of organization improves efficiency, reduces the risk of errors in regulatory documentation, and promotes seamless, consistent processes across the real estate business.

2. Task Flow and Sequencing for Efficient File Setup

One of the main challenges in managing transaction coordination processes is ensuring every required action is performed at the right time. Sequencing tasks within the SOP creates a standardized process, ensuring that each step is followed in the correct order to avoid redundancies and missed steps.

Example Task Flow Sequence:

- Data Collection: Gather and verify essential details from the client and property records.

- File Setup: Create the primary folder and subfolders based on document categories.

- Data Entry: Input core data into relevant sections, ensuring consistency with customer service standards.

- Document Upload: Add required documents to each categorized folder as they’re received, maintaining an audit trail.

- File Review: Check for completeness, ensuring that all documents meet regulatory and legal compliance.

By defining this sequence in an SOP, TCs can ensure consistency and reduce repetitive tasks across transactions, allowing them to focus on providing exceptional customer service.

3. Naming Conventions and Version Control

Document naming conventions and version control are critical in maintaining the clarity and organization of a transaction file. A clear, consistent naming structure allows anyone accessing the file to know exactly what it contains without needing to open each document.

Suggested Naming Convention Format: [ClientLastName_PropertyAddress_DocumentType_Date]

This structure provides essential context, making it easy to identify the document type, client, and property at a glance.

Example Names:

- Smith_456OakSt_PurchaseAgreement_2023-10-15.pdf

- Jones_789PineRd_InspectionReport_2023-11-01.pdf

Using version control methods like date stamps or a specific versioning system helps TCs track changes, maintain records for compliance with industry standards, and ensure that only the most recent documents are used. Outdated versions can be moved to an “Archive” folder to avoid confusion.

4. Collaborative Access and Permissions Management

Transaction coordination often requires multiple team members or agents to access files, update details, and verify information. Setting up an SOP that includes collaborative access guidelines and permission levels promotes effective teamwork while maintaining data security.

For example, using a platform like Google Drive or a specialized tool like ListedKit allows you to set permissions based on roles. Real estate agents may need view-only access to certain files, while TCs have editing permissions. Defining these permissions in the SOP helps prevent accidental data loss or unauthorized modifications.

Example Collaborative Access Levels:

- View Only: Real estate agents or third-party collaborators

- Edit Access: Transaction coordinators and management

- Admin Access: Supervisors or brokers for audit purposes

This setup promotes efficient procedures and improves data security, reducing the chance of customer complaints due to mishandled information.

5. Compliance and Quality Control Checkpoints

Given the regulatory standards and legal requirements governing real estate transactions, incorporating quality control checkpoints is essential in every SOP. These checkpoints act as critical control points where TCs verify data accuracy, compliance with fair housing laws, and completeness of transaction files.

Examples of Quality Control Checkpoints:

- Document Verification: Confirm that required documents are properly signed, dated, and in compliance with regulatory standards.

- Data Accuracy Check: Review all client information for accuracy, ensuring compliance with industry standards.

- Final Review: Conduct a last verification before closing to check that all steps meet legal compliance and internal quality standards.

Having these checkpoints integrated within the SOP helps TCs address complex procedures with greater confidence, ensuring regulatory compliance and exceptional service quality.

Document Naming and Organization Techniques

A strong naming and organization protocol is at the heart of any successful transaction file setup. In addition to standard naming conventions, there are a few strategies that can further enhance file organization:

- Date Stamps for Versioning: Label files with the date of creation or last modification to keep records in chronological order.

- Categorized Subfolders: Group documents within broader categories by relevance or transaction stage, such as “In Progress” and “Finalized.”

- File Indexing: Create an index or master list of all documents stored within a transaction file for quick reference.

These techniques contribute to a well-organized system that saves time, prevents information loss, and supports a smooth, professional transaction process.

Key Data Entry Steps for Transaction Files

Accurate data entry is essential to avoid errors that can derail a transaction. Here are the main data entry points to include in the SOP:

- Client Contact Information: Standardize fields like full names, addresses, phone numbers, and email contacts. A consistent format for these details reduces potential errors and improves customer service.

- Property Details: Enter key property information such as address, MLS number, and inspection dates. This ensures all data complies with legal requirements and helps avoid costly mistakes.

- Transaction-Specific Dates: Map out essential dates such as contingency removal, inspection deadlines, and closing dates. Using a digital calendar or task system helps set reminders to meet these deadlines, preventing delays.

An SOP that clearly outlines these steps with detailed instructions simplifies the process for coordinators of any experience level, minimizing the risk of oversight and ensuring smooth adherence to legal and regulatory standards.

Checklist Creation for Required Documents and Tasks

Checklists are crucial in a standard operating procedure document as they help TCs maintain thoroughness and accuracy.

- Core Document Checklist: Include high-level categories such as contracts, disclosures, inspection reports, and appraisals. This checklist should act as a starting point for any transaction.

- Customization Options: Create additional sections in the checklist for specific transaction types, such as short sales or cash offers, to tailor each setup to the unique needs of the client.

- Approval Points: Identify points in the checklist where document verification or managerial approval is required, ensuring that files meet quality standards and legal compliance.

Using a checklist format for these tasks adds structure, improves efficiency, and helps coordinators provide exceptional customer service by reducing errors.

How ListedKit Can Help Automate Your Transaction Setup SOP

With tools like ListedKit, TCs can further streamline their processes by automating key parts of the SOP, which reduces repetitive tasks and enhances workflow efficiency.

1. Task Automation and Reminders: ListedKit can automate task assignments according to your SOP, set reminders for critical dates, and reduce manual task management, ensuring that each task follows the SOP step guides.

2. Document Storage and Access: The centralized document storage in ListedKit keeps files organized and secure, allowing for easy access and collaboration while maintaining adherence to regulatory requirements.

3. Template Customization: ListedKit supports the customization of templates, enabling TCs to align templates with specific team needs or transaction types without deviating from standardized operating procedures.

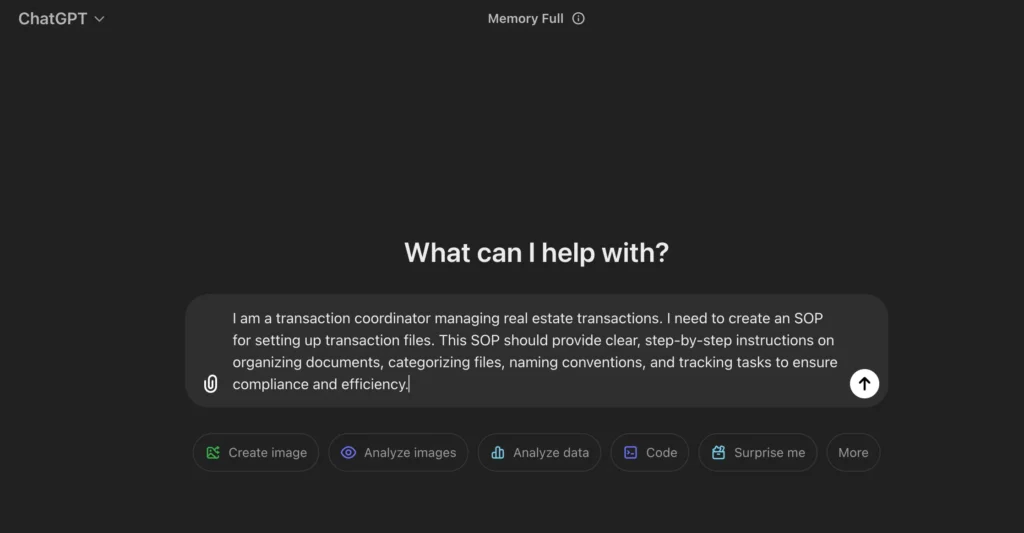

ChatGPT Prompts to Build Your Transaction File Setup SOP

Using AI to manage real estate transactions is the new trend. ChatGPT is one of the tools that you should try as you can provide prompts, and it’ll easily give you some valuable results that you can edit and use.

These prompts will guide you in structuring an SOP that aligns with your transaction coordination needs, focusing on document organization, task sequencing, data entry, and checklist creation.

Step 1: Define the Purpose and Scope of Your SOP

Start by defining the purpose and scope of your SOP. Clearly establishing these foundations helps ChatGPT generate targeted responses, ensuring that your SOP aligns with the specific requirements of transaction coordination.

Prompt: “I am a transaction coordinator managing real estate transactions. I need to create an SOP for setting up transaction files. This SOP should provide clear, step-by-step instructions on organizing documents, categorizing files, naming conventions, and tracking tasks to ensure compliance and efficiency.”

Output Example:

1. Preliminary File Organization

- Create a New Transaction Folder: Begin by setting up a dedicated folder for each transaction on your preferred file storage system (e.g., Google Drive, Dropbox).

- Standard Subfolders: Include subfolders for essential categories:

- Contracts and Agreements

- Disclosures and Compliance Documents

- Inspection Reports

- Closing Documents

- Naming Conventions: Follow a naming format for consistency (e.g., [Transaction ID]_[Document Type]_[Date]). Example: 12345_Contract_2024-10-30.

2. Document Categorization and Filing

- Incoming Documents: Route incoming documents to the appropriate subfolder immediately.

- Categorization Rules: Define criteria for categorizing unique documents (e.g., seller vs. buyer documents, inspections).

- Regular Audits: Set a routine for reviewing all documents to confirm accurate categorization.

3. Document Naming Conventions

- Standard Naming Structure: Use a standardized format for each document type. Consistency helps in quick identification.

- Template Example: [Client Last Name]_[Document Type]_[Date].

- Avoid Special Characters: Use only letters, numbers, and underscores to ensure compatibility across devices.

4. Task Tracking and Compliance Checks

- Task List Setup: Create a checklist or use project management software to track each step in the transaction process.

- Due Date Monitoring: Use reminders for compliance deadlines and set periodic reviews to catch missing items.

- Document Verification: Before closing, review all folders to ensure required documents are correctly categorized and named.

Step 2: Organize Document Categories and Folder Structure

A clear document categorization and folder structure ensures quick access and easy management of transaction files. Define essential document categories and a logical folder hierarchy that complies with industry standards.

Prompt: “I need to categorize documents in a transaction file SOP. Provide categories such as legal documents, client files, and inspection reports, and recommend a folder structure that allows for a clear, hierarchical format.”

Example Output:

- Transaction Folder (Main Folder for Each Transaction)

- Naming Convention: [Transaction ID]_[Client Last Name]_[Property Address]

- Primary Subfolders (Within Each Transaction Folder)

- 01_Legal Documents

- Purpose: Stores all essential legal paperwork related to the transaction.

- Subfolders:

- 01_Purchase Agreement

- 02_Amendments and Addenda

- 03_Disclosures

- 04_Closing Statements

- 02_Client Files

- Purpose: Contains all client-specific documents, such as identification and financial records.

- Subfolders:

- 01_Client Identification

- 02_Loan Pre-approval (if applicable)

- 03_Client Communications

- 04_Client Agreements

- 03_Property Information

- Purpose: Includes documents related to property details, ensuring easy access to relevant information.

- Subfolders:

- 01_Property Details and Descriptions

- 02_HOA Documents

- 03_Survey and Title Documents

- 04_Lien Information

- 04_Inspection and Reports

- Purpose: Dedicated to inspection-related documents for a comprehensive view of property condition.

- Subfolders:

- 01_Home Inspection Report

- 02_Appraisal Report

- 03_Repair Receipts (if applicable)

- 04_Environmental Assessments (if applicable)

- 05_Closing Documents

- Purpose: Contains final transaction documents, stored together for streamlined closing review.

- Subfolders:

- 01_Final Settlement Statement

- 02_Title Insurance Documents

- 03_Transfer Deed

- 04_Post-Closing Instructions

- 06_Compliance and Regulatory

- Purpose: Ensures all compliance documents are securely stored for future audits.

- Subfolders:

- 01_Agency Disclosures

- 02_Regulatory Compliance Documents

- 03_Transaction Coordinator Notes

- 01_Legal Documents

- Additional Tips for File Structure:

- Number Each Folder: Prepending folder names with numbers (01_, 02_, etc.) keeps folders in order.

- Consistency in Naming: Apply consistent naming within subfolders for quick identification.

- Archive Completed Documents: For completed transactions, consider creating a separate “Archives” folder to distinguish between active and completed files.

Step 3: Develop Naming Conventions and Version Control

Standardized naming conventions and version control help ensure that transaction files are organized and easily searchable. Establishing clear naming conventions will make it easier to track documents and avoid confusion.

Prompt: “Suggest a naming convention and version control method for transaction files, including examples.”

Example Output:

Use the following format for each file:

Copy code: [Transaction ID]_[Document Type]_[Client Last Name]_[Property Address]_[Date]_[Version]

- Transaction ID: Unique identifier for the transaction.

- Document Type: Brief description (e.g., PurchaseAgreement, InspectionReport).

- Client Last Name: Client’s last name, helping to quickly identify client-specific files.

- Property Address: Street number or property identifier.

- Date: Use the YYYY-MM-DD format for easy sorting.

- Version: Include version control tags like v1, v2, Final, or Revised.

Example Naming Conventions

- Initial Drafts:

- 12345_PurchaseAgreement_Smith_123MainSt_2024-10-30_v1

- 12345_InspectionReport_Smith_123MainSt_2024-10-31_v1

- Revised Versions:

- 12345_PurchaseAgreement_Smith_123MainSt_2024-10-30_v2

- 12345_InspectionReport_Smith_123MainSt_2024-10-31_Revised

- Final Versions:

- 12345_PurchaseAgreement_Smith_123MainSt_2024-10-30_Final

- 12345_InspectionReport_Smith_123MainSt_2024-10-31_Final

- Post-Closing Updates:

- 12345_FinalSettlement_Smith_123MainSt_2024-11-05_Final

- 12345_TransferDeed_Smith_123MainSt_2024-11-05_Final

Version Control Method

- Versioning Labels:

- Use v1, v2, v3, etc., for initial drafts and internal revisions.

- Use Revised for major changes after a review.

- Label the finalized version as Final.

- Folder for Older Versions:

- Create an “Old Versions” subfolder within each document category (e.g., Legal Documents > Old Versions). Move older versions here when a new version or final document is saved.

Step 4: Outline Key Data Entry Steps

Accurate data entry is critical to avoiding errors in transaction files. Define the essential data entry steps to ensure that all necessary information is consistently recorded and compliant with real estate regulations.

Prompt: “List the key data fields required in transaction file setup, focusing on client details, property information, and critical transaction dates.”

Example Output:

Client Details

- Client Name: Full name of the client (e.g., John A. Smith)

- Contact Information:

- Phone Number: Primary contact number

- Email Address: Primary email for communication

- Mailing Address: Current mailing address (if different from property address)

- Preferred Contact Method: Phone, email, or other specified method

- Agent or Representative (if applicable):

- Agent Name: Full name of the real estate agent

- Contact Details: Agent’s phone number and email address

Property Information

- Property Address: Full address of the property, including unit number if applicable

- Property Type: Single-family home, condo, multi-family unit, commercial, etc.

- Property ID or APN (Assessor’s Parcel Number): Unique identifier assigned by the local government

- Listing Price: Initial listed price of the property

- Offer Price: Agreed-upon price for purchase

- Property Condition Notes: Brief description or notes on the property condition or notable features

- HOA Information (if applicable):

- HOA Name: Name of the homeowners’ association

- HOA Contact Information: Phone and email for HOA communications

Critical Transaction Dates

- Offer Date: Date the offer was made by the buyer

- Acceptance Date: Date the offer was accepted by the seller

- Contract Signing Date: Date the purchase agreement was signed by all parties

- Due Diligence Period Start/End: Start and end dates for the due diligence period

- Inspection Date: Scheduled date for property inspection

- Appraisal Date: Scheduled date for property appraisal

- Contingency Period End Date: Deadline for contingency removals (e.g., financing, inspection contingencies)

- Financing Approval Date: Date financing approval is confirmed by the lender

- Closing Date: Date set for closing the transaction

- Post-Closing Follow-Up Date: Date to confirm all post-closing tasks are complete

Step 5: Build a Checklist for Required Documents and Approvals

A checklist ensures every necessary document is included in the file setup and allows for quality control through designated approval points.

Prompt: “Create a checklist for essential documents and tasks in transaction file setup, including when approvals are needed.”

Example Output:

Transaction File Setup Checklist

1. Initial Setup

- Create Transaction Folder with subfolders for Legal Documents, Client Files, Property Information, Inspection and Reports, Closing Documents, and Compliance.

- Assign Transaction ID for consistent file naming.

- Document Log setup for tracking versions and document updates.

2. Document Collection and Filing

Legal Documents (Requires Client and Agent Approval)

- Purchase Agreement (signed by all parties)

- Due Date: Within 24 hours of acceptance

- Addenda/Amendments (if applicable)

- Due Date: As issued

- Approval Needed: Client and agent initial/signature

- Disclosures (Seller Property Disclosure, Lead-Based Paint, etc.)

- Due Date: Within due diligence period

- Approval Needed: Client initial/signature

- Title Report and Insurance (if applicable)

- Due Date: As received

Client Files

- Client Identification (Driver’s License or ID copy)

- Due Date: During onboarding

- Loan Pre-Approval Letter (if applicable)

- Due Date: At offer acceptance

- Approval Needed: Loan officer approval

- Client Communication Log for tracking correspondence

- Update as needed

Property Information

- Property Description and Features

- Due Date: Initial setup

- Survey and Title Documents (if applicable)

- Due Date: As received

- HOA Documents (if applicable)

- Due Date: Prior to due diligence end

- Approval Needed: Client review/acceptance

Inspection and Reports (Requires Client Approval)

- Home Inspection Report

- Due Date: Immediately after inspection

- Approval Needed: Client review/acknowledgment

- Appraisal Report

- Due Date: As received from lender

- Environmental Assessment (if applicable)

- Due Date: As applicable

- Approval Needed: Client review/acceptance

Closing Documents (Requires Client and Agent Approval)

- Final Settlement Statement

- Due Date: Prior to closing

- Approval Needed: Client and agent signature

- Transfer Deed

- Due Date: At closing

- Title Insurance Documents

- Due Date: At closing

- Post-Closing Instructions (if applicable)

- Due Date: After closing

Compliance and Regulatory

- Agency Disclosures

- Due Date: Prior to contract signing

- Approval Needed: Client initial/signature

- Regulatory Compliance Documents

- Due Date: Upon contract initiation

- Transaction Coordinator Notes

- Update as needed

3. Verification and Approval Tasks

- Document Review: Verify all documents for accuracy and completion.

- Signatures and Initials Check: Ensure all required parties have signed and initialed documents.

- Approval Confirmation: Confirm approvals from clients, agents, and other stakeholders where required.

- Version Control: Ensure only final, approved versions are labeled and stored in the main folders, moving drafts to “Old Versions.”

4. Task Tracking and Final Compliance

- Compliance Checklist Completion: Review compliance documents for accuracy and completion.

- Pre-Closing Review: Confirm all necessary documents are organized, approved, and ready for closing.

- Post-Closing Archival: Move closed transaction files to the “Archived Transactions” folder for record-keeping and future reference.

Final Thoughts

An SOP for setting up transaction files brings clarity and consistency to real estate business operations, helping TCs manage both simple tasks and complex transactions with ease.

By following structured guidelines for file organization, data entry, and compliance, TCs can improve both operational efficiency and customer satisfaction.

Using tools like ListedKit to automate the process further enhances workflow, enabling TCs to focus on delivering exceptional service.

Download the included ChatGPT prompts guide to help you build or refine your SOP, ensuring it aligns perfectly with your workflow, supports regulatory compliance, and meets the highest standards of customer service.