Closing on a house moves at different speeds depending on the transaction type. While cash buyers may close within a week, financed purchases often take 30 to 45 days due to loan approvals, inspections, and title work.

As a real estate agent, you frequently manage client expectations regarding timelines. Buyers and sellers want quick closings, but many factors influence the process. Knowing what impacts closing speed allows you to guide your clients efficiently.

This breakdown explains how long a closing typically takes, factors affecting speed, and steps to help transactions progress without unnecessary delays.

Typical Closing Timelines: Cash vs. Mortgage Deals

Every real estate transaction follows a different closing timeline, depending on financing, contingencies, and legal requirements.

Cash buyers typically close faster than those using mortgage loans, but even cash sales require processing time for title searches, legal documents, and ownership verification.

Cash Transactions (Typically 7-14 Days)

A cash buyer eliminates lender-related delays such as loan applications, underwriting, and mortgage approval. However, other essential steps still apply:

- Opening Escrow & Earnest Money Deposit. Cash buyers often open escrow and deposit earnest money, though some may close directly through an attorney or title company.

- Title Search & Preliminary Title Report. The title company confirms legal ownership, checks for outstanding liens, and identifies potential title issues.

- Property Inspections & Seller Disclosures. While not required for cash sales, buyers may conduct home inspections to identify hidden defects or structural concerns.

- Closing Procedures & Final Payments. The settlement agent coordinates the final sale price transfer, deed recording, and key handoff.

Mortgage-Backed Transactions (30-45 Days)

Most real estate closings involve mortgage loans requiring lender approvals, financial verification, and regulatory compliance. The extended timeline includes:

- Loan Pre Approval & Mortgage Application. Buyers submit financial documents, tax returns, and proof of income for pre-approval, which can take several business days to two weeks.

- Opening Escrow & Earnest Money Deposit. After contract acceptance, buyers deposit earnest money into escrow, and the title company begins its verification process.

- Appraisal & Loan Status Update (LSU). Lenders order an appraisal report to ensure the home’s market value aligns with the purchase price. If the appraisal comes in low, renegotiation may be necessary.

- Loan Conditions Removal & Final Loan Approval. Once the lender confirms all conditions are met, they approve the loan and issue the closing disclosure at least three business days before closing (TRID Rule).

Key Factors That Affect Closing Timelines (and How to Handle Delays)

Several factors can speed up or slow the process, even when buyers and sellers agree on a closing timeline. Anticipating these challenges helps agents prevent delays and keep transactions on track.

Financing & Lender Processes

- Loan Type Matters. Conventional loans close faster than VA or FHA loans, which require additional verification. The lender’s efficiency also plays a key role in processing times.

- Credit Score & Loan Approval. A strong credit score speeds up mortgage approval. Buyers with high debt or recent financial changes may face additional lender scrutiny.

- Pre Approval Process. Buyers who secure mortgage pre-approval early shorten the time from application to closing.

How to Avoid Delays: Buyers should avoid new credit inquiries or large purchases before closing, as these can impact loan approvals and mortgage rates. Agents should maintain contact with lenders for status updates.

Home Inspections & Appraisals

- Scheduling Backlogs. Suppose inspectors or appraisers are in high demand. Scheduling delays can push closing dates.

- Appraisal Disputes. A low appraisal may require renegotiation, delaying loan approval.

How to Avoid Delays: Buyers should schedule inspections and appraisals immediately after contract acceptance to prevent timing issues. Exploring payment assistance or renegotiating terms can help if an appraisal comes in low.

Title & Legal Issues

- Legal Ownership & Public Records. A title company must verify the seller’s legal right to transfer the property. Outstanding liens, unpaid property taxes, or estate disputes can take weeks to resolve.

- Title Insurance & Title Search. Buyers need title insurance to protect against financial loss from undiscovered liens, recording errors, or ownership claims.

How to Avoid Delays: Sellers should resolve title concerns before listing and ensure all ownership records are current. If disputes arise, a real estate attorney may need to step in.

Contingencies & Negotiations

- Inspection Contingencies. Many buyers request repairs, which can extend closing timelines.

- Loan Terms & Price Adjustments. If lenders reject the original loan estimate, financing terms may need to be renegotiated.

How to Avoid Delays: Buyers and sellers should agree on contingency deadlines early and clarify repair expectations to prevent last-minute changes.

Buyer & Seller Readiness

- Missing Documents at Closing. Buyers may forget proof of homeowners insurance, additional financial documents, or identity verification.

- Escrow Items & Earnest Money. Sellers sometimes delay closing until escrow funds are fully cleared.

How to Avoid Delays: Agents should use transaction management tools to track required documents and send deadline reminders.

As an agent, you must actively ensure that all parties stay on schedule by anticipating potential roadblocks. Managing expectations and keeping everyone informed helps prevent last-minute surprises that could jeopardize a closing.

Missing Mortgage Satisfaction Delays Closing

Here’s a real-life example from Proplogix. A homeowner paid off their mortgage in 1999, but the satisfaction was never recorded.

Over the years, the mortgage was transferred through four different lenders, leaving gaps in the title history.

When the homeowner tried to sell, the title company refused to clear the property due to missing assignments.

Attempts to resolve the issue stalled for six months, as the final lender, CitiMortgage, would not release the mortgage without a complete title record.

A title specialist tracked down the missing assignment from a successor bank and submitted it to CitiMortgage, avoiding a quiet title lawsuit.

Key Takeaways:

- Title searches must confirm legal ownership and unpaid liens.

- Title insurance protects against recording errors.

- Missing documents can delay real estate closings for months.

Practical Steps to Close Faster

While real estate agents can’t control every factor, proactive planning helps speed up transactions.

Get Pre-Approved for a Mortgage

- A mortgage pre-approval streamlines the loan process by confirming buyers qualify for financing.

- Pre-approved buyers have faster underwriting times and locked-in mortgage rates, reducing uncertainty.

Work with an Organized Transaction Coordinator

- Agents using transaction management tools reduce errors and communication gaps.

- Avoids delays caused by missing financial documents, purchase loans, and escrow items.

Stay Proactive with Paperwork & Deadlines

- Buyers should submit income verification, Social Security details, and financial readiness documents early.

- Sellers should resolve title concerns before listing to avoid legal setbacks.

- Completing the initial closing disclosure in advance prevents last-minute adjustments.

Schedule Inspections & Appraisals Quickly

- Buyers should contact real estate agents to schedule inspections and secure professional home inspectors immediately.

- If an appraisal report is delayed, buyers can ask their lender if an expedited appraisal service is available. However, appraisals must be completed by an approved appraiser assigned by the lender and cannot be switched mid-process.

Negotiate Closing Terms Upfront

- Buyers should discuss closing cost credits, periods for contingencies, and legal documents early.

- Cash buyers can offer incentives for sellers to agree to 7-10-day closings.

How Real Estate Agents Can Keep Transactions on Track

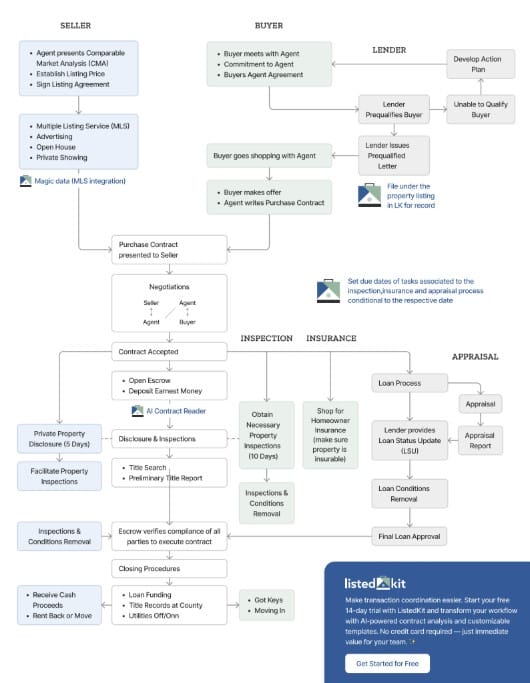

Real estate agents are central to all communications, coordinating between buyers, sellers, lenders, title companies, and escrow officers.

A delayed closing can frustrate clients, affect commission timelines, and jeopardize deals. Here’s what you can do to stay organized and proactive:

Use a Centralized Platform for Transaction Management

- Helps track closing documents, property appraisals, and requests for documentation.

- Simplifies communication between mortgage brokers, closing attorneys, and real estate sales professionals.

Maintain Clear Communication with All Parties

- Regularly check in with mortgage lenders, title companies, and closing agents to confirm progress.

- Respond to lender requests for financial documents, additional documents, and asset documentation quickly.

Set Realistic Expectations for Clients

- Buyers should understand the difference in closing times between conventional mortgages and equity loan closing processes.

- Sellers should know their obligations for property taxes, proof of homeowners insurance, and required repairs.

Create a Closing Checklist

- Buyers should prepare earnest money, escrow deposits, and final mortgage payments ahead of closing day.

- Sellers should arrange for all real property and personal property transfers.

Stay on Track with ListedKit

Managing multiple transactions, documents, and deadlines can quickly become overwhelming. But ListedKit simplifies the process by centralizing everything in one platform. You can track every transaction stage, monitor compliance, and automate client updates.

With ListedKit’s AI-powered contract reviewer, you can quickly review agreements for accuracy, ensuring compliance with legal requirements before closing day. Plus, the custom client portal informs your buyers and sellers, minimizing back-and-forth communication.

Keep Your Closing on Schedule with the Right Tools

Closing timelines vary based on financing, legal requirements, and transaction complexity. Cash deals typically close within 10-14 days, while mortgage-backed purchases take 30-45 days due to lender approvals and inspections. Delays often stem from title issues, financing setbacks, or missing documents.

To ensure a smooth closing:

- Encourage mortgage pre-approval. This reduces financing delays and strengthens buyer offers.

- Stay ahead of paperwork. Submit financial and title documents early to avoid last-minute hurdles.

- Schedule inspections and appraisals quickly. Book professionals as soon as the contract is signed.

- Clarify contingency deadlines. Negotiate terms upfront to prevent unexpected delays.

- Use a transaction management platform. Track contracts, deadlines, and compliance requirements.

Agents who stay proactive prevent costly mistakes and keep transactions moving. ListedKit simplifies this process by centralizing all tasks in one platform, helping you manage closings efficiently. Get started today!